This leads us to our first actual post on money and finance, and we should start by asking why is this a necessary topic.

Alluded to above, the theory most people have been taught about money is false, and after a 40 year fight the central banks are acknowledging this fact. This means that the arguments and assertions most people make are often, unknowingly, incorrect.

Let's start by covering some useful facts: most large nation states don't have reserve requirements. And, the money supply is not created by banks accepting deposits first and then lending them out. Instead, banks create money when they issue a loan, and no pre-existing deposits are required to issue that loan. The bank creates money when it writes entries on its balance sheet.

As such, money is technically two things at the moment it is created by a private bank or money creating entity, such as a non-bank financial intermediary (aka shadow bank): an asset (A) and a liability (L). These two components are bound together by the legal contract which creates them, such as a mortgage loan created by a bank and signed by a borrower. When the liabilities are returned to the contract, the asset and liability are then deleted from the balance sheet of the bank (destroyed). Money pops into and out of existence according to the lending practices of banks and loan repayment.

There are multiple kinds of money, globally organized in a hierarchy of importance, for example:

$ Federal Reserve Deposits

$ Commercial Bank Deposits

$ Eurodollar Bank Deposits

$ Private contracts

When people use language like: "there is insufficient reserves in the system" or "reserve liquidity is too low" they are talking about a specific form of money, Federal Reserve Deposits. These are just like the deposits you and I have in our commercial bank accounts, except that they belong to account holders who bank with the Federal Reserve (checking accounts of the banks at their bank, the Fed)--you and I cannot open reserve accounts at the Fed, we cannot hold reserves in digital form. However, cash is essentially a reserve deposit in physical form, and we can hold cash. Similarly, we can open accounts at the Treasury (https://www.treasurydirect.gov/) to purchase US Gov securities directly, which is very similar to being an account holder at the Fed (you become, essentially, an account holder at the Treasury which is an account holder at the Fed).

The hierarchy of money is a outcome of historical circumstance. A great source covering this topic in detail is this book here: https://www.amazon.com/Battle-Bretton-Woods-Relations-University/dp/0691162379/ref=sr_1_1?crid=12M70BIUIWIBJ&keywords=battle+of+bretton+woods&qid=1652974414&sprefix=battle+of+bretton+woods%2Caps%2C160&sr=8-1

In short, the US deposed the UK through clever finance and replaced the Pound Sterling with the US Dollar as the primary means of all financial settlement in the early 1940's. If you had to read one source in this thread, The Battle of Bretton Woods would likely be the most applicable to military history and education and is the easiest to read.

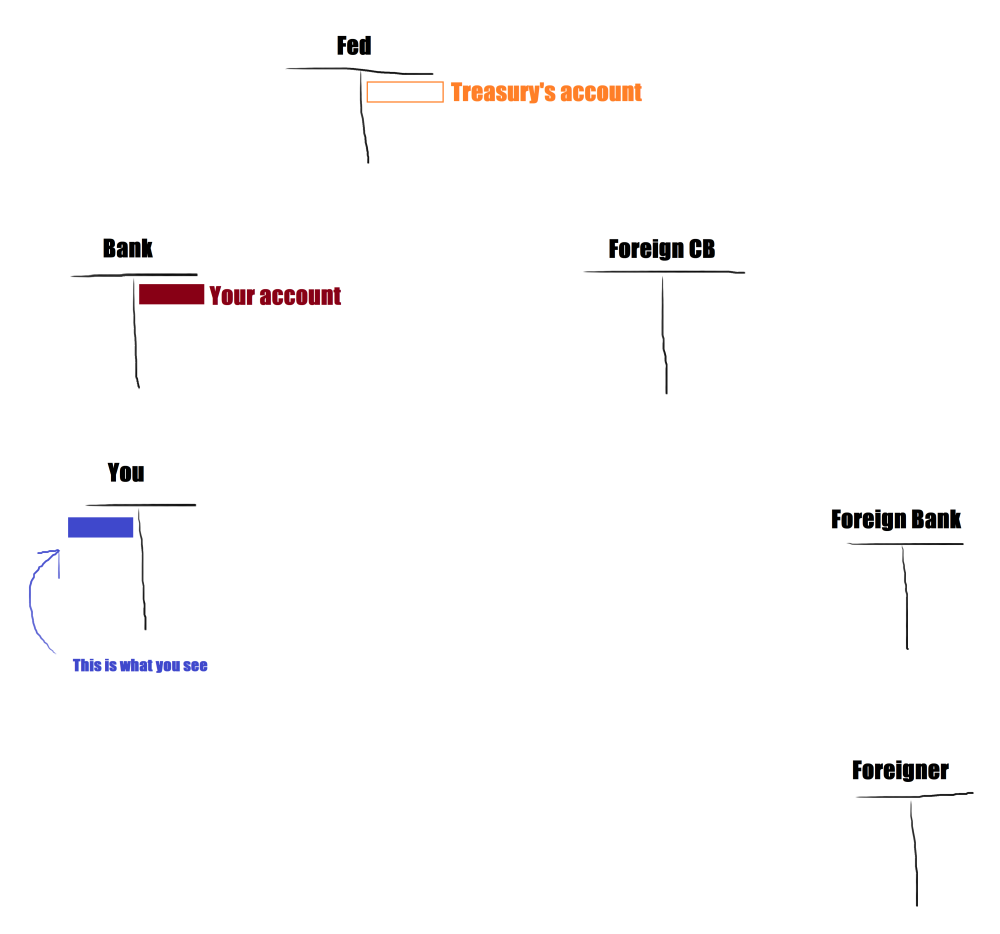

We visualize the hierarchy very simply with a set of balance sheets corresponding to each bank, and their account holders. Here you can see your account at your bank, which is simply an entry on that bank's balance sheet. Similarly, your bank is account holder at the Fed, as are foreign central banks and some foreign banks.

What you see in your account is just the bank's liabilities they have assigned to you. These numbers do not represent physical objects or cash at the bank, or any bank, they are just numbers in the liability side of the bank's ledger.

For matters about the government's debt level, taxation and government borrowing, we are interested in the account at the Fed for the Treasury, called the Treasury General Account (TGA). You can see the balance in the TGA at the Fed, you can always see the TGA at the Fed online, pirctured here below:

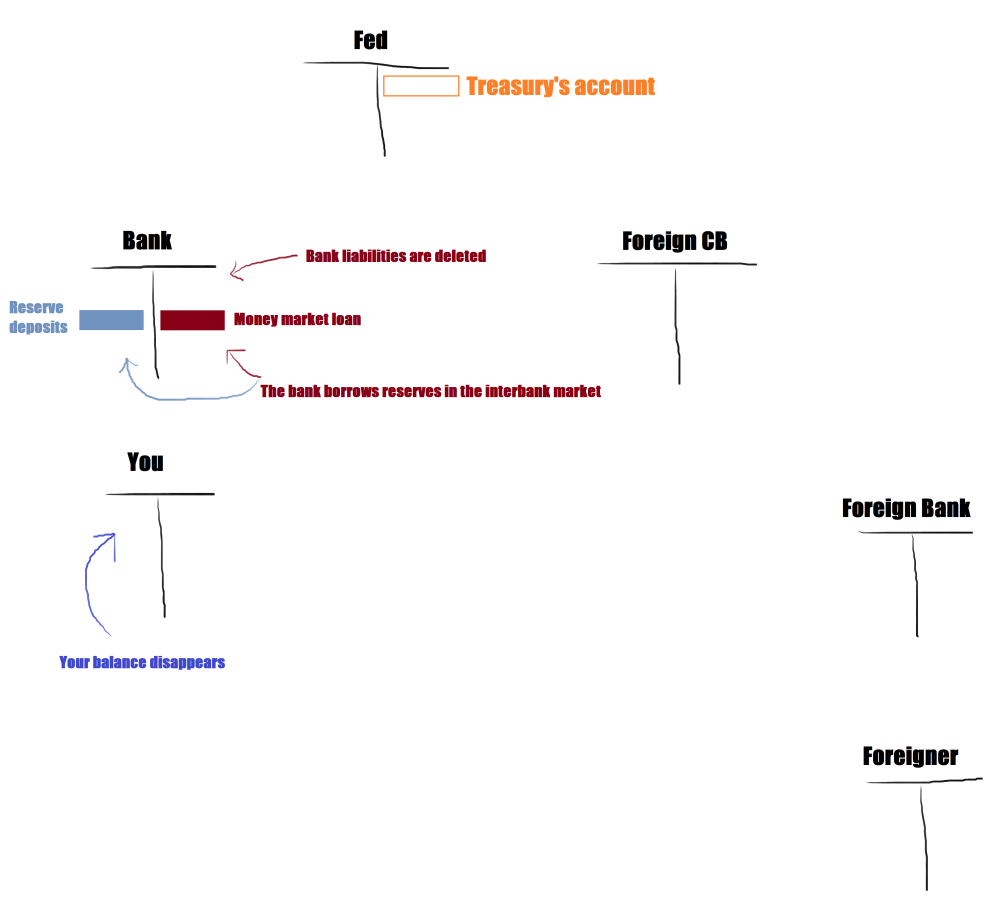

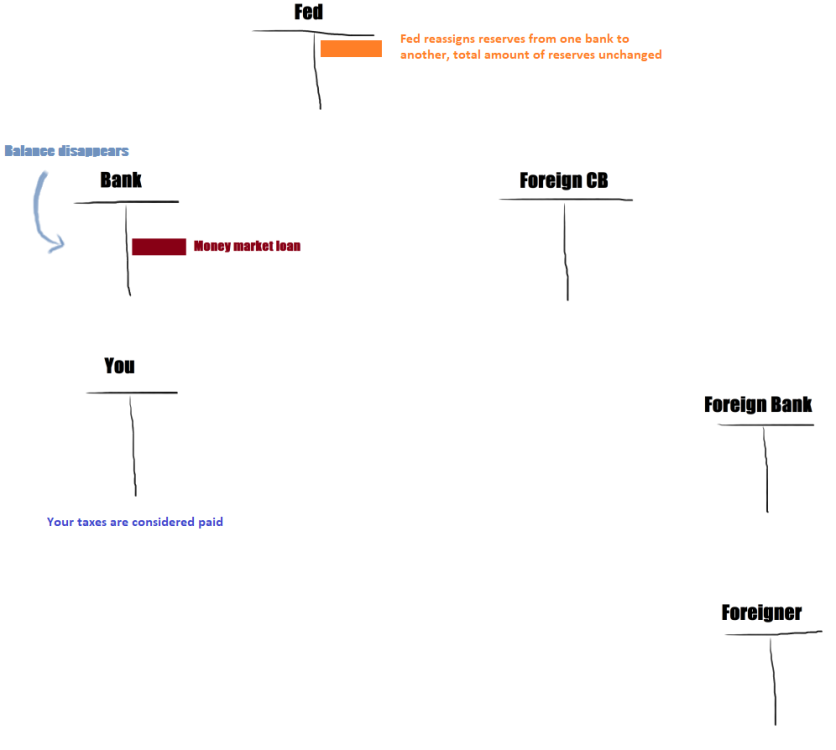

When you pay taxes, bank deposits in your account are deleted from your bank's ledger. And, reserve deposits in your bank's account at the Fed are also deleted. The Fed then marks up the TGA. Subsequently, taxation removes reserve deposits and commercial bank deposits from the system. We can say that taxation reduces liquidity, as it reduces the total amount of 'money' that people can use for payments from the financial system and places it in the TGA. Running a gov surplus thus reduces the capacity of the private sector to make payments, which increases fragility.

Running through the balance sheets of a tax payment: your bank deletes its liabilities it assigned to your account, and your balance disappears from your account. The bank then borrows reserve deposits in the interbank market which it will use to complete your desired payment to Treasury.

-------------------------------------------------------------------------------------------