Random Guy

Registered User-

Posts

108 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Random Guy's Achievements

Crew Dawg (2/4)

-44

Reputation

-

Aren't dirndls Bavarian, and Bavarians aren't German?

-

OMG a critical mass of interest paying assets! Imagine all the interest cashflows to bank accounts! NOOOOoooooooo......

-

And please, guys, there is no collection of coins that elves come by to collect to send to Ukraine. Money is just numbers typed into a computer. You can type lots of numbers into an account on the Fed ledger to buy weapons you make yourself, or goods and services produced abroad. It has zero impact on domestic spending capability.

-

Why are boomers still so upset at Russia, that they want to look at pictures of dead kids who were born in Russia after the cold war?

-

"To promote federal taxes, Morris meanwhile began proposing that the Congress collect a 5 percent tax on all imports countrywide. That tax is known to readers of founding history as “the impost,” and it was subject to famous political battles in the wartime Congress, involving the early collaboration of Madison and Hamilton. Today the impost can sound innocuous and logical. It would tax only imports, not products made in America, not land, not income. But many books on the period don’t mention that the impost wasn’t intended to supply the army or pay soldiers but to pay federal bondholders their interest. Many also don’t mention that, to Morris, the impost on foreign goods was only a wedge. Once people were inured to direct federal taxation, Morris told his followers, federal poll taxes, land taxes, and excise taxes would follow. To ensure payment to the creditors, Morris intended, as he’d put it before, to open the purses of the people. The federal impost faced stiff opposition in the Congress. Taxing power was sovereign power, and many states had no intention of giving it away. At first Morris hoped to slip the federal impost through Congress as just one more revenue bill: it took only nine states to ratify such a measure. The state legislatures, however, quickly recognized the tax bill for what it was, a revision of the articles by which the confederation had been formed. Any amendment required unanimous approval of the member states. So Hamilton and Madison began collaborating in the cause of federal taxation. They were lawyers. Hoping to get the impost through without having to submit to the amendment process, they looked for existing legal powers to impose taxes on the states. In later years, Hamilton would be accused—by Madison—of concocting a doctrine of “implied powers” of government: anything a body is explicitly empowered to do, the doctrine says, implies other, inexplicit powers necessary to getting that thing done." Taxes and federal debt never worked the way most people think they do. Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a Nation (Discovering America) https://a.co/d/7pL34T6

-

Most transfers were 'in kind'. But how can a ledger 'not have money'? Did they run out of numbers or something?

-

I like how folks think the US has nothing to gain from being the largest provider of natural gas to western Europe. Thanks for giving us a cold winter guys.

-

I don't recommend doge coin or time shares. This is financial advice.

-

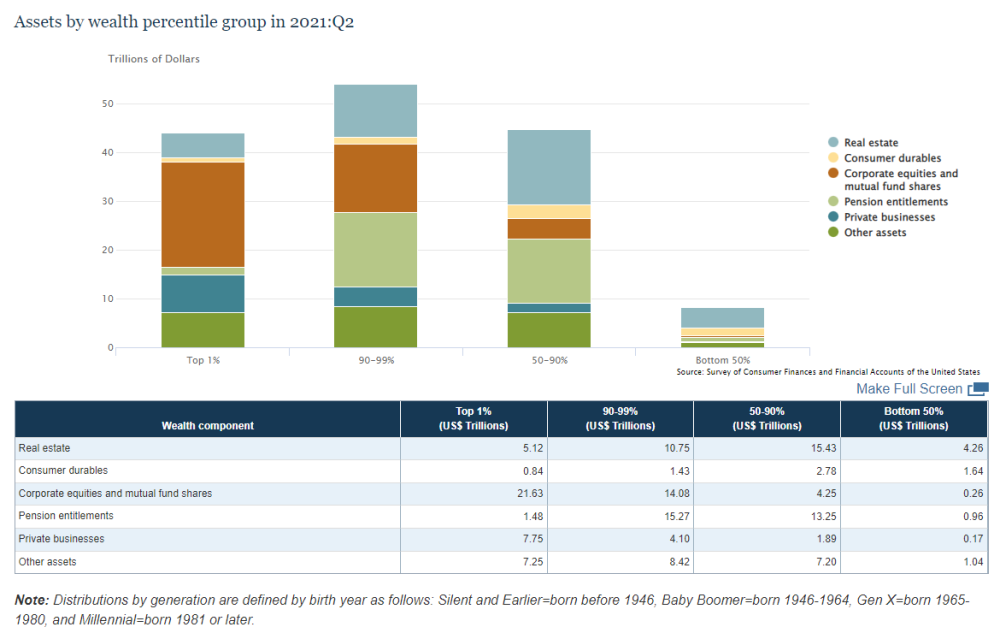

Let's assume that Russia doesn't stop at Ukraine, despite the fact they can barely support ongoing operations, much less project power further (IMO). Regardless, for the sake of argument they are a mighty global military power intent on conquering the EU. 😈 Given that, in what way is the distribution of specialization in violence beneficial to the EU and the US? Generally, there is no meaningful military capability in Europe. There are too many languages for successful operations integration, and the financial system of the the Eurozone can't support increases to military spending (the so-called 'debt-brake' restricts EU state deficit spending at 3% of total spending [GDP] in the past year). The EU is trapped within liberal-imposed austerity, by structural design of the EU itself. The only correcting mechanism they have to protect themselves from financial bubbles is a fund of about €350B. Technically, national central bank purchases of state gov debt are illegal according to the Maastricht treaty itself. Instead of fixing these problems, EU member states join NATO and expect the US to provide 100% of defense capabilities. Meanwhile, the US economy becomes over-specialized in war and finance. We produce millions of military personnel and trillions of equipment in USD terms, while our spending on things like childcare, family support, certain forms of healthcare* are marginalized by comparison. The 'middle class' @nsplayr refers to doesn't really exist anymore. When we look at the largest components of wealth in the 'middle class', we see home equity (bubble) and pensions (remember, only 11% of private workers today have a pension, so these are mostly gov worker pensions). The bottom 90% of the wealth distribution is composed mostly of gov worker pensions and a housing bubble. So long as NATO exists, the EU has no incentive to properly integrate and increase their defense provision. Europeans literally ignore foreign policy as a concept, and even now, there is little interest within Europe in the conflict in Ukraine. People think it's the US' problem. I would argue this doesn't make much sense. The Europeans should be providing their own defense capabilities, as equals.

-

Re: fixed currency systems (such as a gold standard). The US current account is -$291B and it has ~8000 metric tons of gold, or $459B in terms of USD, given current prices per metric ton of $57M. How long do we think the US would be able to maintain gold outflows if import settlement is demanded in gold, especially when we consider domestic demand for USD conversion to gold? It's possible the US wouldn't be able to maintain a gold peg for even one year, maybe even a single quarter. I'm curious how you imagine the US fixing its currency to gold would turn out. Is the US gov depleted of gold a net win? Would something cause the US to be less reliant on imports? How would the US conduct domestic investment to reduce dependency on imports with gold settlement in place?

-

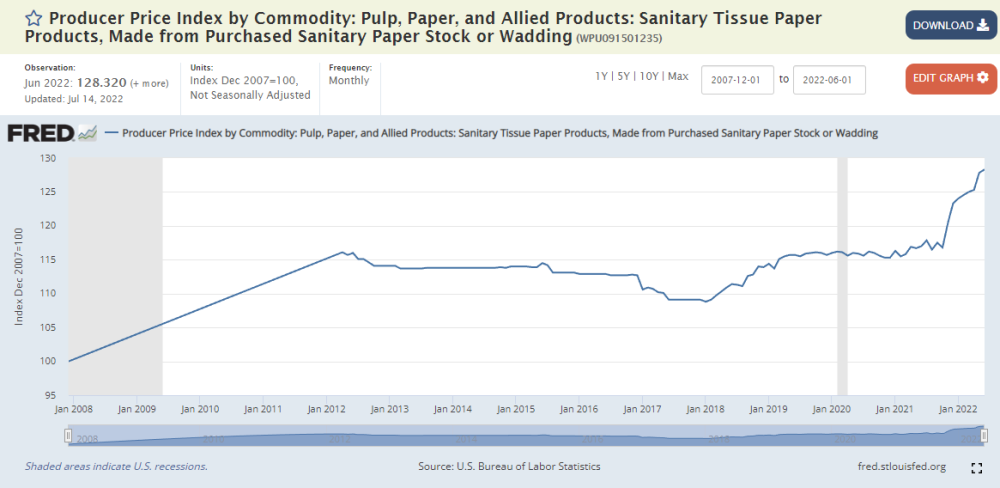

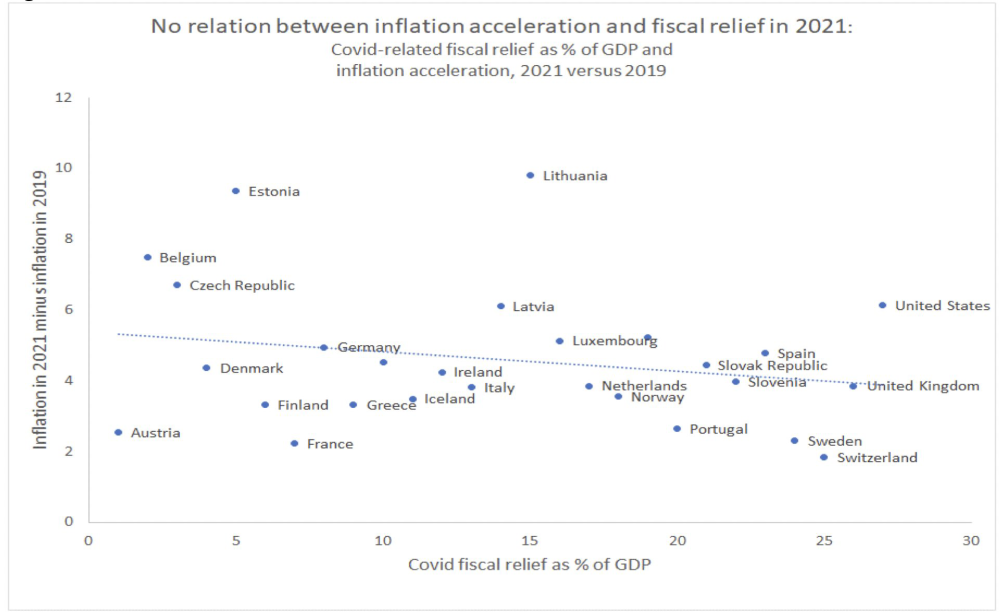

When the video claims that constraints in supply always lead to inflation (non-monetary inflation), we can provide examples of industries with very visible shortages but no price changes, typically because there is no relative power of producers or customer themselves hold power. Example, toilet paper and other sanitary paper products during the lockdowns. Despite frequently empty shelves prices were constant:

-

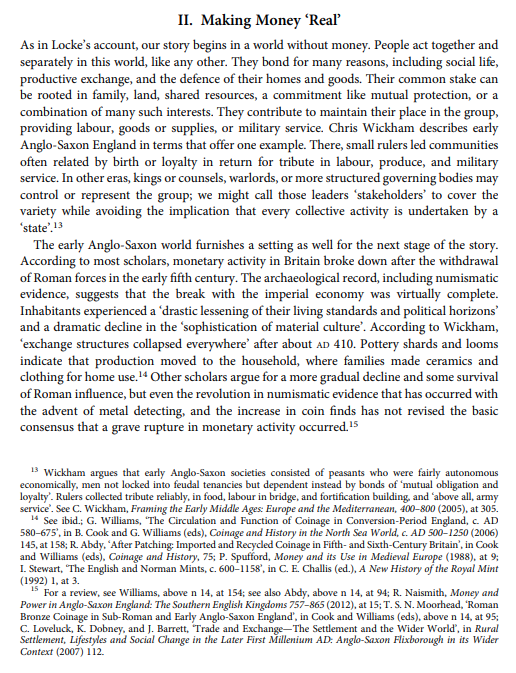

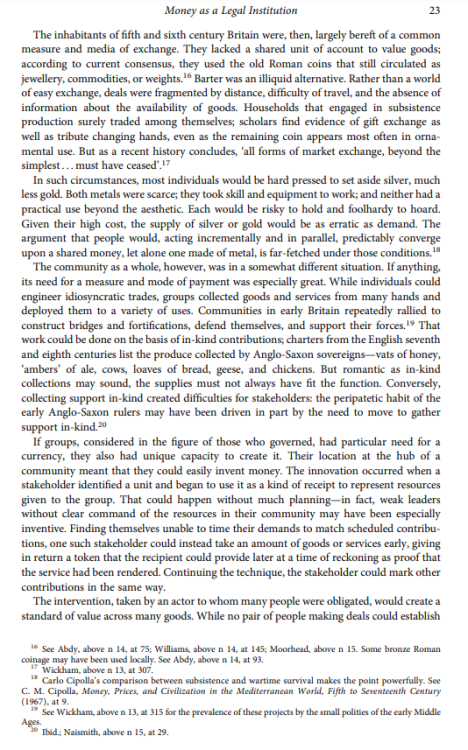

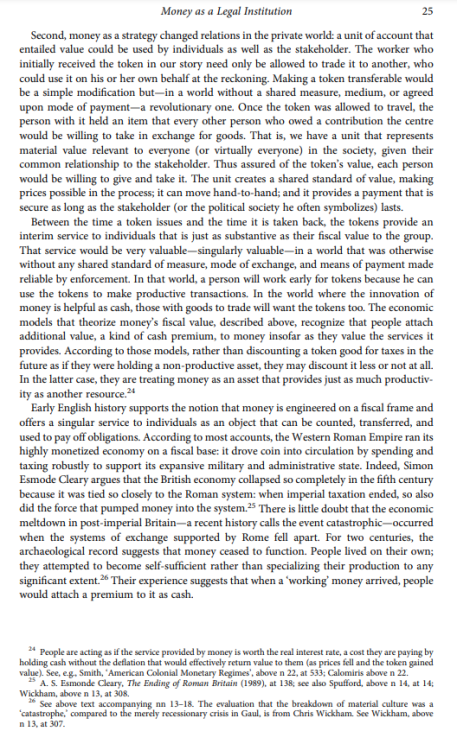

We can trace the origin of money from early civilization in Sumer through Egypt, Greece, and Rome. The video claims that what gave Roman coins value was the metal itself (with silver being more valuable than copper, because metal has intrinsic value). This is false. Here are excerpts from Desan covering the creation of money as instruments of 'value' (links available in earlier in the thread), and how the origin of value in fungible units was not the metal itself:

-

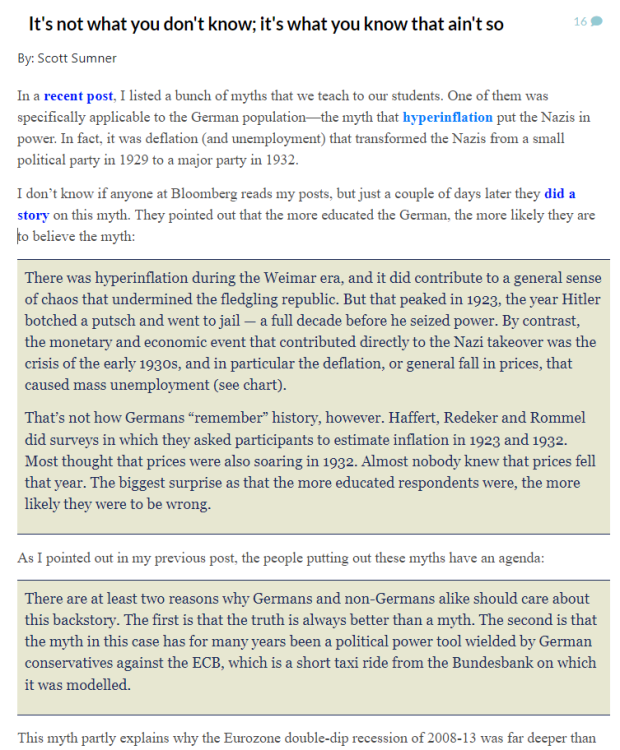

Thanks for sharing. I want to debunk alot of what's offered in this video, so I'm going to go through section by section, starting with the components that are most commonly misunderstood (myths), especially the 1921 hyperinflation in Germany. I know that most people here might not like Tooze as a source, instead many republicans rally around people like Scott Sumner, so I'll provide a link to his work as well. In short, the rise of national socialism in Germany was caused by deflation, not the hyperinflation which occurred over a decade earlier. This myth tends to be commonly understood by everyone in the US, while an actual understanding of money dynamics are not. In fact, the austerity policies following WW1 which were implemented in Germany were universally pursued and the largest contributor of deflation-induced political unrest which began in the 1930's. Which brings us to the first two sections of the video: coinage and the history of money in Rome & British Isles. What causes coinage to have value, why did rulers 'cry-up' or 'cry-down' their currencies, why was metal content often changed, and how did this affect prices. Generally, Desan is the best source for a modern understanding of coinage, although there are many others. The video begins with Rome, but this is some 3000 years later than the earliest recorded money known today, which is best represented in the clay tablets used for recording ledger entries in early Sumer (modern day Iraq). They even developed a method of signing ledgers, not unlike modern cryptographic hash functions (it's not ironic that many of these artifacts wound up in the personal libraries of bankers like J.P. Morgan, who themselves sought a deeper understanding of 'how money worked'). Many of us may have walked over the ground or even seen archaeological pieces of this society during our deployments and not noticed it, including the salt deposited throughout the territory, which accumulated over time from the irrigation ditches used to cultivate the land. The water from the Turkish mountains contains trace amounts of salt which became lethal to wheat and later barley over 2000 years of irrigation. It was these ditch digging activities which led to some of the earliest forms of money. Contrary to the video, we should really begin our investigation of money and inflation at the beginning, with the Sumer clay tablets, silver coinage, and barley unit of account. This was a monetary economy, with commodity money settlement (silver and barley), executed almost entirely with complex credit systems recorded on ledgers.

-

-

Max pain @nsplayr