All money is 'printed'.

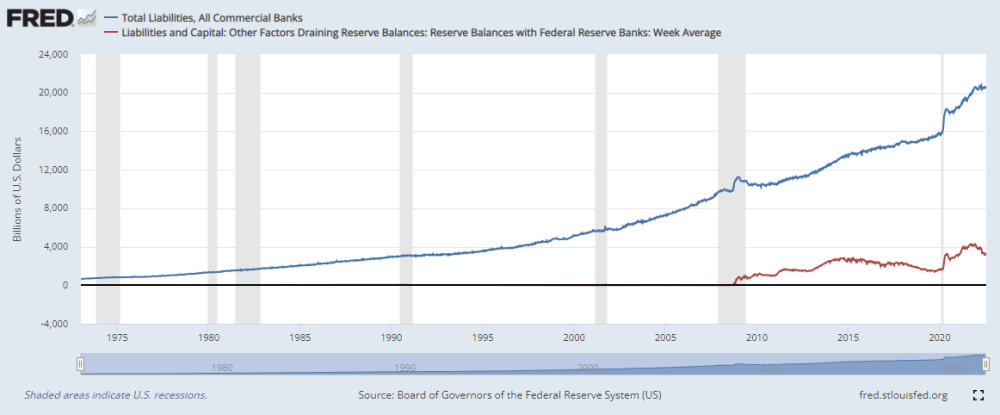

Whether its the Bureau for Engraving and Printing (which creates cash, a Fed liability), the Mint (coins, a Fed liability), the Fed's ledger (digital reserve deposits, a Fed liability), or the Treasury (US Treasuries aka money market collateral, a Treasury liability).

We think that this stuff is money, but 97% of money is private. Created by private banks. And there is no other money. So what's different between the Fed (a bank) creating a loan to buy a financial asset, and Wells Fargo creating a loan via a credit card for you to buy a financial asset? We can replace what we're buying, rather than a financial asset, we could buy an airplane (F-35 vs a Boeing commercial aircraft), pay employees (gov payroll, firm payroll financed via commercial paper), etc.

The action is identical, the purchase equivalent--but your belief is that one is printing money, but the other is not. When in fact they are the same. All money is 'printed' by banks.