-

Posts

394 -

Joined

-

Last visited

-

Days Won

3

MilitaryToFinance last won the day on November 10 2015

MilitaryToFinance had the most liked content!

Contact Methods

-

Website URL

https://

-

ICQ

0

Profile Information

-

Gender

Male

-

Location

New York

Recent Profile Visitors

MilitaryToFinance's Achievements

Flight Lead (3/4)

97

Reputation

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

You almost never get inflation under control while real rates are negative. So even if you use 5% PCE inflation, they need to keep raising rates until 5.5%+.- 1,226 replies

-

- sdp

- weekly trading

- (and 8 more)

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

And Citadel hired a bunch of planes to spray chemtrails all over the country. They're probably the ones sneaking fluoride into our water too. There are actual regulatory reasons why Robinhood and a number of other brokers did what they did on Thursday. And once you think about the mechanics of shorting a stock it is quite easy to understand how the shares short can be greater than the free float. But it seems people are having more fun ranting and raving about "the elites" so I won't let explanations spoil the fun.- 1,226 replies

-

- sdp

- weekly trading

- (and 8 more)

-

I'm not a fan of really hoppy/bitter beers personally. But if you want something with some kick, the Tank 7 from Boulevard Brewing is really good. 8.5% alcohol, Belgian style saison which admittedly some people hate. It's a KC brewing company but I can find it at my grocery store in NY from time to time so has pretty wide distribution. https://www.boulevard.com/beerinfo/tank-7-farmhouse-ale/

-

The WOKE Thread (Merged from WTF?)

MilitaryToFinance replied to tac airlifter's topic in Squadron Bar

On behalf of those of us in NY, please don't give Steve Cohen ideas for his new stadium... -

-

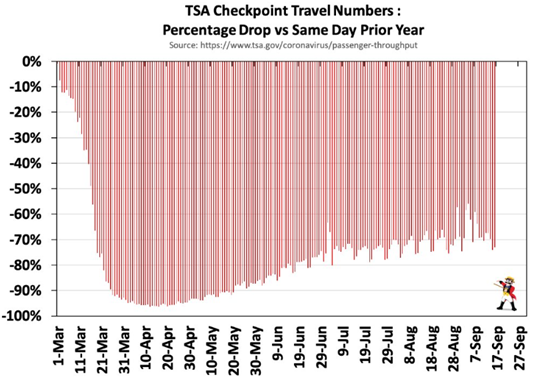

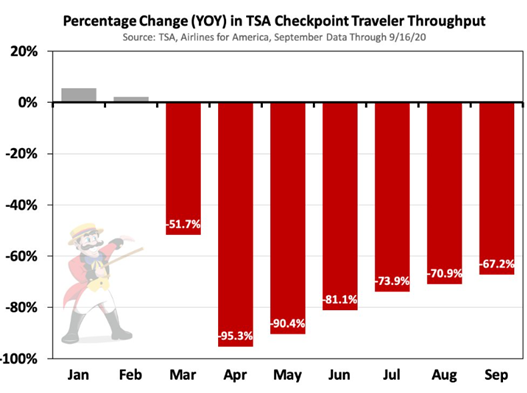

Yeah I expected a slow recovery but this has been worse that I initially thought as well. The interesting thing about the daily graph, that is impossible to see in the picture, is the weekly cadence. The year over year declines is consistently worse on Tues/Wed compared to Thurs-Sun of the same weeks. So recreational travel flights are coming back faster than business travel that happens mid-week. Even with a vaccine I wonder how much that business travel will recover. Clearly it will snap higher than today because I talk to plenty of companies who complain that they really do need to go visit sites/customers/plants. But I'm attending a lot of conferences and meetings over Zoom that are more efficient for everybody than wasting a day or two traveling for the same meeting. Even when leisure travel comes back to "normal" if the high-paying business travelers aren't there the math gets tough for the airlines. Probably a good time for Jet Blue and Southwest, not so sure how American/Delta/United fare without raising ticket prices.

-

Not to be Debbie Downer but this is so much worse than 9/11 for the industry. After 9/11 RPMs dropped ~35% and were down ~30% for the next 5 months before slowly recovering from there. 6 months in right now and things are still twice as bad as the worst of the 9/11 shock. Yes the industry will find a balance and these numbers will improve but at what level and how many planes do we need today vs. a year ago? Now that the furlough protections from the Fed bailouts are going away I think things are going to get ugly even with the airlines getting more funding.

-

Not sure if this belongs here or in the airlines thread. Qantas is sending their final 747 off to the graveyard and the pilot took the opportunity to draw a kangaroo in the sky on his way out.

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

I think this is what's going on right now.- 1,226 replies

-

- 1

-

-

- sdp

- weekly trading

- (and 8 more)

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

I ended up selling my preferred stock a few weeks after our previous discussion in June 2019 so I haven't paid as close attention over the last year. I would say there have been some concrete steps made in moving forward with the plan to get out of conservatorship. They have reserves against foreclosures right now and I don't really see it getting bad enough to cause a big problem for them. I'm more concerned about retail backed properties and some office values than I am residential mortgages. My biggest concern with FNMA/FMCC right now is the election. If Trump wins you probably get them released to be public companies again under his second term. If Biden wins I don't know that this gets done before Jan 2021.- 1,226 replies

-

- 1

-

-

- sdp

- weekly trading

- (and 8 more)

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

SPACs have terrible track records when bought at NAV and "better burger" restaurants are a dime a dozen now with almost no barriers to entry. If you're treating this like a penny stock promotion and hoping the squeeze keeps running so you can sell to a greater fool tomorrow that's always possible. If you think you're getting a value buying it at over $18 before the deal even closes I think you should do some more detailed research and reassess your valuation.- 1,226 replies

-

- sdp

- weekly trading

- (and 8 more)

-

The WOKE Thread (Merged from WTF?)

MilitaryToFinance replied to tac airlifter's topic in Squadron Bar

-

Taking everything with a grain of salt knowing their obvious bias I'm not sure how much interesting was said. Todd was the most aggressive about buybacks but it was mentioned a few times. He also pulled out the MAGA card at the end which was amusing. Lots of discussion on how firm the "no furloughs" stance really is. General consensus that the government needs to mandate (not just issue guidelines) PPE requirements so people will feel safe traveling. Southwest rep seemed to imply they had too many pilots going into this mess but I'm not sure if he misspoke in his opening remarks or I misunderstood him. Eric Ferguson: Allied Pilots Association, American Airlines Chris Kenney: JetBlue Master Executive Council (ALPA) Todd Insler: United Executive Council (ALPA) Ryan Schnitzler: Delta Master Executive Council (ALPA) Jon Weaks: Southwest Airlines Pilots’ Association Todd: We need the Federal government to press hard to take this seriously, mandatory wearing of masks. Chris: We need mandatory requirements, not guidelines or suggestions from the CDC Jon: Need to be prepared with data and knowledge to help get confidence of traveling public back. Help understand the risk reward to make people feel ok traveling. We have 10k pilots, to correct overstaffing we already had, need to help company decide how to maneuver. Ryan: This is a revenue problem, not a cost problem. Our costs were fine 3 months ago. Eric: Goal is to avoid involuntary furloughs. We have short, medium, and permanent leave. 6%-7% took permanent leave of absence and well received so far. Think we will be ready when the demand comes back. Todd: Working to mitigate furloughs, CARES act guarantees pay through October and we might need another bite at the apple. Looking through a myopic tube in forecasting the future staring at the current environment. Think furloughs won’t be as bad as some forecast. Chris: We are still planning voluntary measures after 1 Oct. Ryan: We are tracking the TSA data closely, still a slow start and many economies still effectively shut down. Believe it will tick up to a more rapid climb with more reopenings. My family is taking a trip in 2 weeks, think the traveling public is ready and it’s time. We have a displacement bid open that I think is oversized, company is giving themselves leeway in whether or not they award them. In my view if they do all of them I’m concerned about being hamstrung in the recovery. Think we need to see what the recovery will look like before we start making drastic changes. Jon: Post-CARES world 1 October, with 30 days notice would need to see furlough info coming out end of August. We had 7%-8% of pilots take emergency time off. Early retirement and extended emergency time off coming in June. Think there will be enough offered that take-up will be sufficient to avoid furloughs. Think the first ETO round was good enough response that the June uptake should be strong too. Eric: Limited by contract to 32% furloughs unless it is something “beyond the company’s control” and will be debated by lawyers. About 1/3rd isn’t protected which goes back to the 2013 merger. Tremendous growth because of retirements since than and those pilots are not protected. I don’t think we will get beyond that 32% anyways. What we need to have is common sense regulation to let flying public feel safe flying. We will hld Mr. Parker to his vision the best we can. Is there a scenario where they furlough enough to have to rip out seats from these regional jets? Was that ever envisioned being enforced? Todd: This is an act of government and corporate policy, not an act of god. These are express choices being made. Insatiable desire to increase EPS with stock buybacks rather than pay down debt is not the pilot’s fault. Our business model makes money hand over fist but it was not our choice in how that money was spent. Will the market change or will they demand dividends and buybacks again in the near future? I sent them my personal socket wrench they can use to remove the seats if they want to go down that path. Contract is designed to be difficult, it is to prevent the airline from making poor decisions like furloughs as a knee-jerk reaction. Ryan: I don’t think we would even be having this conversation if the buybacks hadn’t happened. Removing 6 seats from 76 seat regional jets are protections to dissuade them from making bad choices. The contract specifically excludes using an economic crisis for force majeure. Sounds like it will be a cold day in hell before the unions will get behind the idea of buybacks in the future or is there some balance? Eric: We have long complained about over-indulgence in buybacks. We are all in the same boat because our companies didn’t build fortress balance sheets going into this. Todd: We need to decide what is a healthy balance sheet. Don’t believe that returning value to shareholders is correct, we are returning value only to some shareholders. Is it better to pay down debt and improve operations so we can charge more for tickets and bring more customers in? Chris: Going forward there needs to be restrictions on this. The company needs to put more money into the company and employees first. JBLU has been aggressive on buybacks but now they are going to try to come to us to help get through this. We don’t have fore majeure clause, ours is also “out of company control” which might be tested. What will we do to help mitigate to prevent furloughs. Our CBA is new and hasn’t been tested yet but it is based on traditional clauses. Eric: Restrictions also makes business sense, especially legacy with huge training volume given numerous platforms. Just a few months ago we were talking pilot shortages and those retirements are still looming. Is seniority negotiable at this point? Eric: Absolutely not, there is no way we will compromise that system. About safety, not just pay protection. Todd: Offering early-out to the top of the list is one way management is bypassing the seniority problem to try and take cost out. Ryan: Any time you can use voluntary that is the preferred path. You can use a targeted approach towards where you really need the reductions, trying to create avenues like what American has done to have least amount of negative impact. Would you support consolidation in the industry? Jon: Would want to build on the Airtran acquisition but I don’t think we are in that situation yet. Looking at what equipment is available with bankruptcies outside the US already. Want to protect jobs and make sure Southwest is ready to handle it in the right way. We gave them exploratory relief to try and find options but they haven’t done anything yet. I just don’t see why they would buy rather than build internally with acquired used aircraft. Chris: Bottom line we need to focus on ourselves and our environment. I don’t think M&A is a smart direction right now. Todd: If our revenue is still down 20% next year that means the economic situation in this country is terrible. I’m less concerned that is a real scenario. We want to improve scope clauses (not relaxation) because it is built on 1980’s mentality and there are better ways to do it. Those discussions are on pause until we get past this. Eric: We are always in talks to make improvements and changes to the CBA, not just short-term leave. We will engage them if we believe it will be for mutual benefit to pilots and company. We are in Section 6 right now so technically everything is open. Is the 737 MAX coming back? Jon: We are hearing MAX still has software issues still, anticipating the earliest (more pessimistic than company) 4Q20 before it is in revenue service. Eric: I think timeline is similar. We had secured decent financing for the MAX equipment coming in and will take advantage of that. We have parked our older and less efficient airplanes. But not a front burner issue. If another country came in with an offer to inject capital would you be supportive of that? Todd: How is that going to make America great? I think there is no appetite for that. How did that work out for Air Italy? Ryan: If we go back 3 months ago airlines looked like a great investment and we will be again. Think there is plenty of capital in the US to get us back to that point again. I don’t think we need Middle East money. Emirates is parking a bunch of their A380’s so they have their own problems. Chris: Foreign capital would endanger our jobs and structure. We would adamantly oppose that regardless of where the money came from (Emirates or Lufthansa)

-

The heads of the major pilot unions are speaking at a conference today. If there is any interest in hearing what they are saying to people outside the industry I can pass along some notes.

-

Investment showdown -- beyond the Roth, SDP, & TSP

MilitaryToFinance replied to Swizzle's topic in Squadron Bar

Bashi pretty much hit the nail on the head but if you still own it, sell it today. They suspending creation of units, the whole ETF is broken and is now trading at a premium to NAV which should not happen. It is very likely this ETF is worth $0 in a month. No matter how much you already lost, you will probably lose 100% of what you have left if you continue to hold it.- 1,226 replies

-

- sdp

- weekly trading

- (and 8 more)