Everything posted by QAZqaz

-

TSP Annual additions limit

Nope you cannot add more than $20.5k (for cy2022) into a Roth TSP (unless a back door Roth TSP exists as mentioned elsewhere in this thread). My plan is to get to like $20.49k into the Roth at the beginning of the year, and then start dumping into traditional because I will be in a CZTE for almost all of 2022. My question was basically how do I do that through MYPAY and will the MYPAY system realize I’m in a czte etc. my wife has been doing the back door Roth (kinda sounds dirty) for years now but I never considered it could be something I could do via TSP. Imagine trying to get information on how to do that from anybody lol I mean I can barely get a voucher processed correctly let alone find someone that knows what a back door Roth is.

-

TSP Annual additions limit

Yeah I read that one before. So my biggest concern is accidentally going over $20.5k and then it locking the additional annual limit ($40.5k traditional) out so I’ll just have to watch it on every paycheck and figure out what month I need to drop the percentage, then on the following month start dropping into the traditional.

-

TSP Annual additions limit

I wonder if the system is smart enough to start dumping money past $20.5k into the traditional TSP if I am getting tax free on my pay stubs? Like after a few months I max the $20.5 and it sees I am in a CZTE and starts putting it into my Traditional TSP up to the $61k limit. This MIGHT be something the TSP people know but so far they've been basically unhelpful and always try to pass the buck to DFAS. This I don't really wanna press to test though and will probably have to watch my mypay stubs every month to figure out the exact percentage for my last month in the Roth TSP to shack it just under the $20.5k limit and then set up the next month for the traditional Roth annual additional limit. And yeah just the fact that DFAS and TSP have no idea how to answer my basic questions tells you something

-

TSP Annual additions limit

So your last paragraph is where I disagree on the execution. For 2022, the conclusion I came to was to max out my $20,500 in my Roth TSP by putting like 55% of my base pay into it, so I can get it finished in 4 months or so. Then after that is maxed out, I will use the annual addition limit to add another $40.5k into it before the end of the year. I will be receiving tax free for every month but December next year, so I think it's possible. The execution of it is the question. I'm thinking what others have said about DFAS/TSP/mypay whoever tracks this stuff will see that I am getting tax free on my pay stubs and I am guessing I will be able to automatically get up to the 61K annual addition limit, but I will have to press to test. This is all to say that I didn't realize one point: Had I known how this works, every time I got a monthly "tax free" on a mission, I was allowed to contribute to the traditional TSP beyond the $20.5k I put into my Roth TSP. So had I known that, I could have been dumping even more than $20.5k into the TSP every year I've flown missions overseas. That said, sometimes it takes a while for the tax free to hit my pay check, and when you edit your TSP contributions they take effect in the following month, so I don't know how to execute on that if the timing isn't perfectly lined up. Can you contribute to the annual additional limit the month after you receive a tax free? And yeah this process is frustrating and shitty because nobody knows anything when you call, and it looks like I will have to monitor every single monthly pay stub to figure out when to cut the monthly contribution down so I don't go over my roth limit initially, and then my annual additional limit after that.

-

TSP Annual additions limit

Thanks, I think I have a shot at maxing it out. Good to know the LES tax free triggers it. Do you have to contribute to the Roth TSP up to $20.5k first or can you contribute to traditional initially? I will have a month where I will not be in a CZTE at the end of year and figured it might be better to contribute to Traditional TSP first, since apparently I can always contribute to the Roth up to $20.5k. By normal contribution limit do you mean the initial $20.5k? Does that mean if I contribute $20.4k into a Roth that i am good to contribute $40k to the traditional, and that if I mess up and contribute $20.6k to the roth that it prevents me from contributing anything to the traditional? I know if you go over the money gets kicked back for the Roth, I just dont know if I am locked out of further contributions to traditional. Viperman: I can find random stuff on what the contribution limits are WRT the amount for normal and additional contributions, but the execution of it is what I wanna get right that can't seem to be answered by anyone. Also, for example, lets say I contribute 50% of my base pay for the first 4 months of the year in Roth and I am stateside, and max out the $20.5k. If I fly into a CZTE in June, does that now mean that I can contribute an additional 50% of my base pay into the Traditional TSP for that month?

-

TSP Annual additions limit

So I’ve tried TSP customer service, DFAS and myPers and nobody can explain to me how to allocate past the $20,500 for 2022. I don’t even know how many months I need to be overseas to max it, or if it’s prorated depending on how many months you spend overseas in a calendar year. Has anyone done this and if so how much can I contribute and how many months do I need to be overseas? What happens if I exceed the limits? Once I max the Roth TSP do I need to then reallocate into the traditional TSP or if I go a penny over the 20,500 allotment does it lock it out the traditional TSP? after hours on the phone I have no answers.

-

Not Promoting to Major

Might be worth a call to your AFPC assignments officer. They might also take into consideration if you have a UIF or whatever. Not trying to hijack the thread but I'm curious to know about if I don't promote to LtCol. Same thing? Or with this 5 look new system (anyone have any info on this all I got is rumint) would you just get to sanctuary and be good to retire?

-

Investment showdown -- beyond the Roth, SDP, & TSP

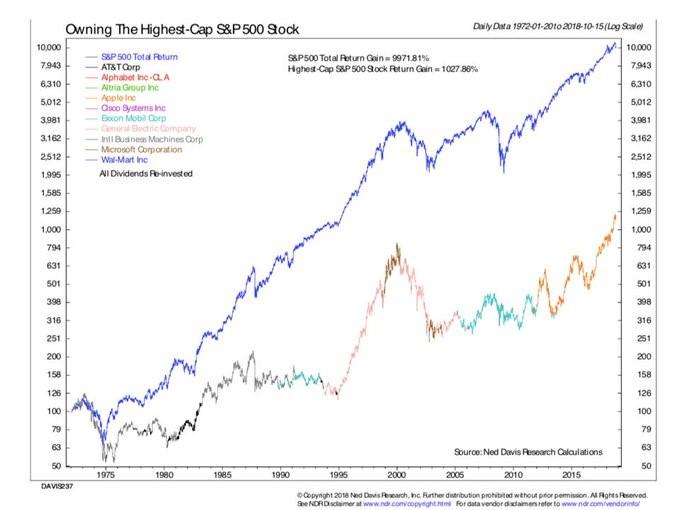

Take a look at this article: https://mebfaber.com/2019/01/06/you-would-have-missed-961-in-gains-using-the-cape-ratio-and-thats-a-good-thing/ "This strategy beat the S&P 500 by four percentage points per year. Despite higher volatility (mostly the good “upside” volatility, by the way), it still resulted in a higher Sharpe ratio and lower drawdowns than sitting in expensive US stocks." The chart that goes along with that quote is definitely worth looking at. CAPE might just be another metric you use to pick countries that look appealing to you. The point though, is these days I'm coming to the conclusion that diversification away from large companies / US companies might be a wise move. It is true that borders matter less and less, but if you're investing in expensive companies, international or not, your future expected returns will still go down. WRT investing in mega caps when they are the largest cap company at the time...see chart below.

-

Investment showdown -- beyond the Roth, SDP, & TSP

How about avoiding home country bias and investing in the world instead of just looking stateside for investment opportunities? There's some good research by Meb Faber on global portfolios. Yes, here at home everything is expensive and there's not many good places to put money. But internationally that's not the case. In fact there has been research suggesting that buying the cheapest 25% countries overall beats the S and P, though will have some years of underperformance. That's the conclusion I came to. The US market is only 50% of the stock world and like 15-20% of the bond world. Anyone on here invest globally? Cambria has some interesting funds like GVAL that I've started diversifying into. Curious on everyone's thoughts.

-

Paying back bonus and getting out

Dude be careful. I don't know how much research you've done WRT private equity but you go down with the ship as an investor if the project fails. Curious to know more details though, like will you be an LP or something?

-

Home Prices

I'll bite. How much of your portfolio do you have in silver? How's that been working out?

-

Captain passed over for Major, looking for advice.

Can you point me in the direction to read about sanctuary WRT active duty? When I looked into this that term was only used for ANG and Reserve. I could not find anything about sanctuary in the AD.

-

Information on PCS/moves/moving (DITY, TMO, DLA, storage)

Sorry if this has been covered but... I PCS for a short tour overseas unaccompanied soon. My wife will be living in the conus while I'm gone. I'm currently OCONUS but still in America. I would like my stuff to stay in storage for the full 1 year tour, as she will be living with family near my duty station once the short tour is over. Finance is saying I will make BAH so the government will not cover the cost of NTS (non temp storage) and I will have to pay that out of pocket for the year I'm overseas. When I asked TMO they said the gov will pay for non temp storage. She is listed as a dependent on my orders and will be allowed to move to a designated location. What doesn't make sense is if she wanted to move to state X while I was gone and then move to my next duty station after my short tour, the gov would be moving our goods twice. If the goods are kept in non temp storage, they will only have to move them once to my duty station after my short tour. Does anyone know the answer to this? Can you point me to a AFI or reg that covers this so I can go to finance and explain their regs to them if need be? Any help appreciated!

-

Retirement / Separation Considerations

Yep that's what I meant. Not sure if it's state dependent. I know WA is community property law, that might factor in.

-

Retirement / Separation Considerations

Correct me if I'm wrong here, but 50% doesn't always apply. For example, if you get married at 15 years into an active duty, then retire at 20, you are with your wife for only 5 years of your 20 served. Therefore, wouldn't she only be entitled to 25% of your retirement, not 50? That's how a lawyer once explained it to me, in Washington state.

-

Retirement / Separation Considerations

Question for you all. When I'm done with my current assignment (MWS IP) I will have 18 years TAFMS (I currently have 15 years in, just got here). I want to get back to my last base and finish my 20 out (also in my MWS). However, I'm at an OCONUS location, and the ADSC to PCS OCONUS to CONUS is only 12 months, so I THINK they can send me anywhere. UPT no longer requires an ADSC but I don't know if they would send me there with only 2 years left (would still need to do PIT and all that). My question is, do I have any say in my final assignment, other than requesting it and hoping for the best? Is there any consideration given to your final assignment before retirement? It seems sanctuary only applies to ANG/ARC, not active duty (from the regs I've been looking at) so I won't have the ability to opt out of another assignment...I don't think. Ideas?