Random Guy

Registered User-

Posts

108 -

Joined

-

Last visited

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Everything posted by Random Guy

-

Aren't dirndls Bavarian, and Bavarians aren't German?

-

OMG a critical mass of interest paying assets! Imagine all the interest cashflows to bank accounts! NOOOOoooooooo......

-

And please, guys, there is no collection of coins that elves come by to collect to send to Ukraine. Money is just numbers typed into a computer. You can type lots of numbers into an account on the Fed ledger to buy weapons you make yourself, or goods and services produced abroad. It has zero impact on domestic spending capability.

-

Why are boomers still so upset at Russia, that they want to look at pictures of dead kids who were born in Russia after the cold war?

-

"To promote federal taxes, Morris meanwhile began proposing that the Congress collect a 5 percent tax on all imports countrywide. That tax is known to readers of founding history as “the impost,” and it was subject to famous political battles in the wartime Congress, involving the early collaboration of Madison and Hamilton. Today the impost can sound innocuous and logical. It would tax only imports, not products made in America, not land, not income. But many books on the period don’t mention that the impost wasn’t intended to supply the army or pay soldiers but to pay federal bondholders their interest. Many also don’t mention that, to Morris, the impost on foreign goods was only a wedge. Once people were inured to direct federal taxation, Morris told his followers, federal poll taxes, land taxes, and excise taxes would follow. To ensure payment to the creditors, Morris intended, as he’d put it before, to open the purses of the people. The federal impost faced stiff opposition in the Congress. Taxing power was sovereign power, and many states had no intention of giving it away. At first Morris hoped to slip the federal impost through Congress as just one more revenue bill: it took only nine states to ratify such a measure. The state legislatures, however, quickly recognized the tax bill for what it was, a revision of the articles by which the confederation had been formed. Any amendment required unanimous approval of the member states. So Hamilton and Madison began collaborating in the cause of federal taxation. They were lawyers. Hoping to get the impost through without having to submit to the amendment process, they looked for existing legal powers to impose taxes on the states. In later years, Hamilton would be accused—by Madison—of concocting a doctrine of “implied powers” of government: anything a body is explicitly empowered to do, the doctrine says, implies other, inexplicit powers necessary to getting that thing done." Taxes and federal debt never worked the way most people think they do. Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a Nation (Discovering America) https://a.co/d/7pL34T6

-

Most transfers were 'in kind'. But how can a ledger 'not have money'? Did they run out of numbers or something?

-

I like how folks think the US has nothing to gain from being the largest provider of natural gas to western Europe. Thanks for giving us a cold winter guys.

-

I don't recommend doge coin or time shares. This is financial advice.

-

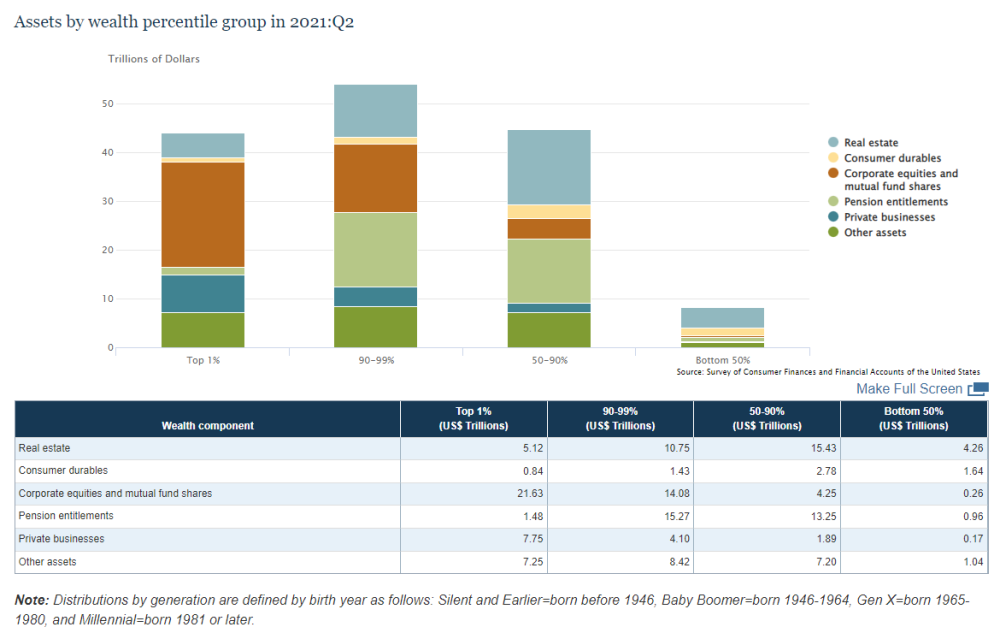

Let's assume that Russia doesn't stop at Ukraine, despite the fact they can barely support ongoing operations, much less project power further (IMO). Regardless, for the sake of argument they are a mighty global military power intent on conquering the EU. 😈 Given that, in what way is the distribution of specialization in violence beneficial to the EU and the US? Generally, there is no meaningful military capability in Europe. There are too many languages for successful operations integration, and the financial system of the the Eurozone can't support increases to military spending (the so-called 'debt-brake' restricts EU state deficit spending at 3% of total spending [GDP] in the past year). The EU is trapped within liberal-imposed austerity, by structural design of the EU itself. The only correcting mechanism they have to protect themselves from financial bubbles is a fund of about €350B. Technically, national central bank purchases of state gov debt are illegal according to the Maastricht treaty itself. Instead of fixing these problems, EU member states join NATO and expect the US to provide 100% of defense capabilities. Meanwhile, the US economy becomes over-specialized in war and finance. We produce millions of military personnel and trillions of equipment in USD terms, while our spending on things like childcare, family support, certain forms of healthcare* are marginalized by comparison. The 'middle class' @nsplayr refers to doesn't really exist anymore. When we look at the largest components of wealth in the 'middle class', we see home equity (bubble) and pensions (remember, only 11% of private workers today have a pension, so these are mostly gov worker pensions). The bottom 90% of the wealth distribution is composed mostly of gov worker pensions and a housing bubble. So long as NATO exists, the EU has no incentive to properly integrate and increase their defense provision. Europeans literally ignore foreign policy as a concept, and even now, there is little interest within Europe in the conflict in Ukraine. People think it's the US' problem. I would argue this doesn't make much sense. The Europeans should be providing their own defense capabilities, as equals.

-

Re: fixed currency systems (such as a gold standard). The US current account is -$291B and it has ~8000 metric tons of gold, or $459B in terms of USD, given current prices per metric ton of $57M. How long do we think the US would be able to maintain gold outflows if import settlement is demanded in gold, especially when we consider domestic demand for USD conversion to gold? It's possible the US wouldn't be able to maintain a gold peg for even one year, maybe even a single quarter. I'm curious how you imagine the US fixing its currency to gold would turn out. Is the US gov depleted of gold a net win? Would something cause the US to be less reliant on imports? How would the US conduct domestic investment to reduce dependency on imports with gold settlement in place?

-

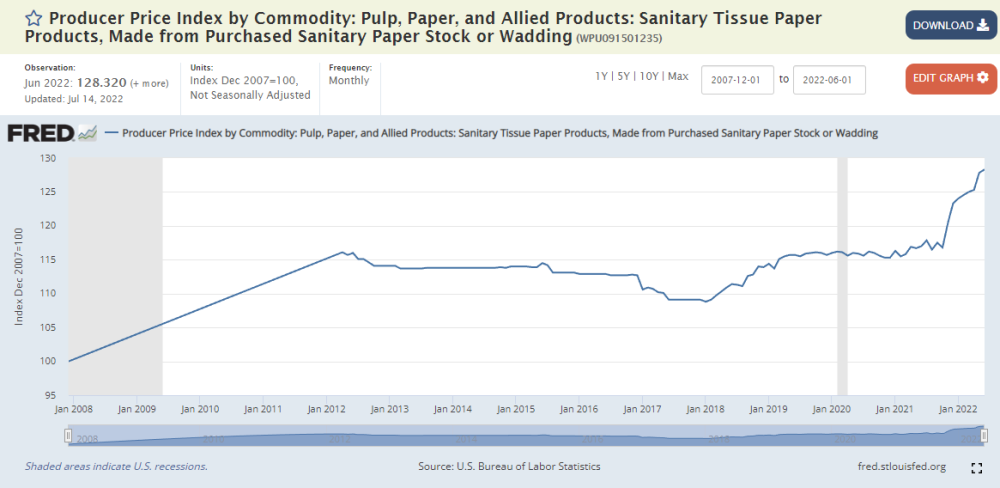

When the video claims that constraints in supply always lead to inflation (non-monetary inflation), we can provide examples of industries with very visible shortages but no price changes, typically because there is no relative power of producers or customer themselves hold power. Example, toilet paper and other sanitary paper products during the lockdowns. Despite frequently empty shelves prices were constant:

-

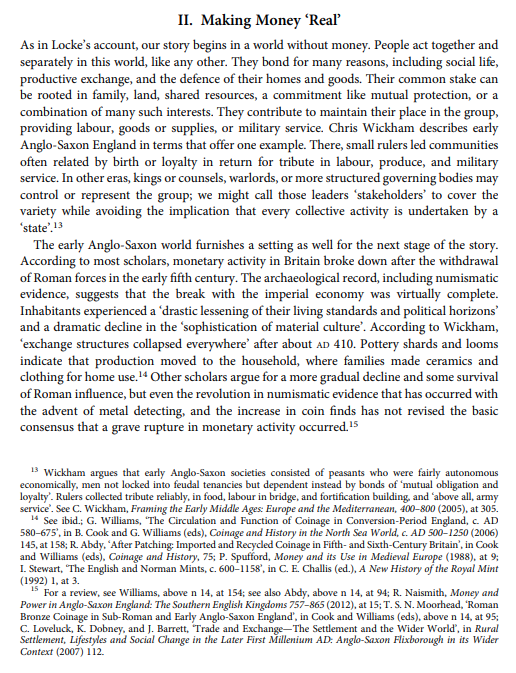

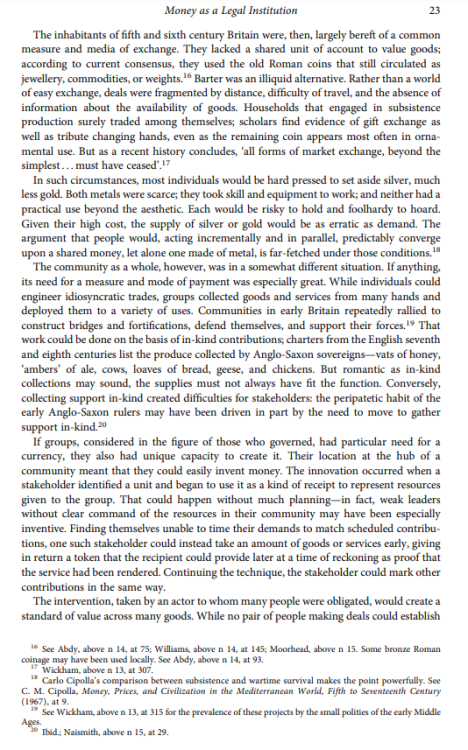

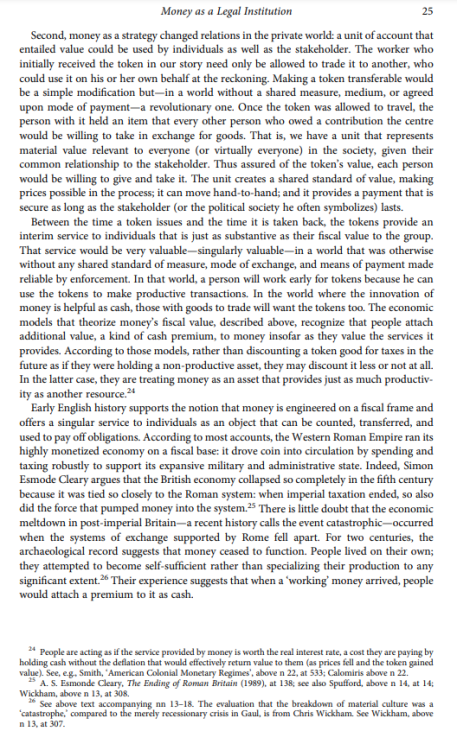

We can trace the origin of money from early civilization in Sumer through Egypt, Greece, and Rome. The video claims that what gave Roman coins value was the metal itself (with silver being more valuable than copper, because metal has intrinsic value). This is false. Here are excerpts from Desan covering the creation of money as instruments of 'value' (links available in earlier in the thread), and how the origin of value in fungible units was not the metal itself:

-

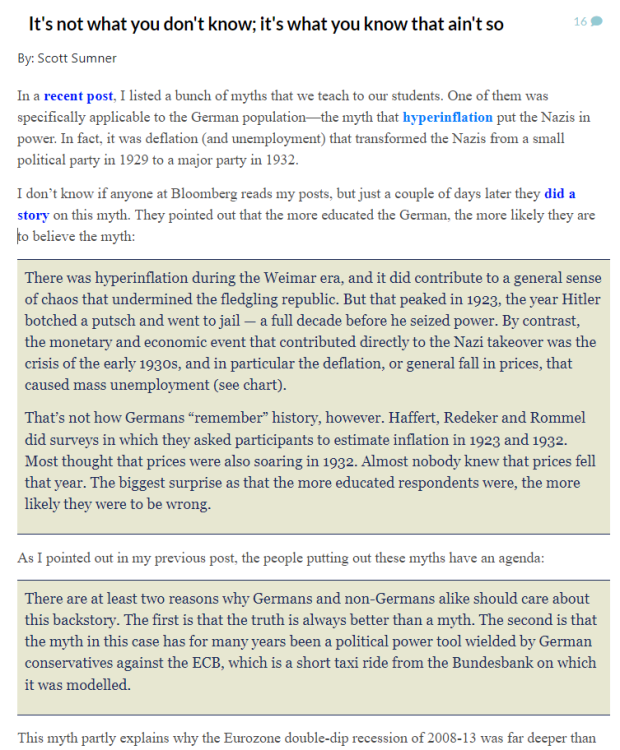

Thanks for sharing. I want to debunk alot of what's offered in this video, so I'm going to go through section by section, starting with the components that are most commonly misunderstood (myths), especially the 1921 hyperinflation in Germany. I know that most people here might not like Tooze as a source, instead many republicans rally around people like Scott Sumner, so I'll provide a link to his work as well. In short, the rise of national socialism in Germany was caused by deflation, not the hyperinflation which occurred over a decade earlier. This myth tends to be commonly understood by everyone in the US, while an actual understanding of money dynamics are not. In fact, the austerity policies following WW1 which were implemented in Germany were universally pursued and the largest contributor of deflation-induced political unrest which began in the 1930's. Which brings us to the first two sections of the video: coinage and the history of money in Rome & British Isles. What causes coinage to have value, why did rulers 'cry-up' or 'cry-down' their currencies, why was metal content often changed, and how did this affect prices. Generally, Desan is the best source for a modern understanding of coinage, although there are many others. The video begins with Rome, but this is some 3000 years later than the earliest recorded money known today, which is best represented in the clay tablets used for recording ledger entries in early Sumer (modern day Iraq). They even developed a method of signing ledgers, not unlike modern cryptographic hash functions (it's not ironic that many of these artifacts wound up in the personal libraries of bankers like J.P. Morgan, who themselves sought a deeper understanding of 'how money worked'). Many of us may have walked over the ground or even seen archaeological pieces of this society during our deployments and not noticed it, including the salt deposited throughout the territory, which accumulated over time from the irrigation ditches used to cultivate the land. The water from the Turkish mountains contains trace amounts of salt which became lethal to wheat and later barley over 2000 years of irrigation. It was these ditch digging activities which led to some of the earliest forms of money. Contrary to the video, we should really begin our investigation of money and inflation at the beginning, with the Sumer clay tablets, silver coinage, and barley unit of account. This was a monetary economy, with commodity money settlement (silver and barley), executed almost entirely with complex credit systems recorded on ledgers.

-

-

Max pain @nsplayr

-

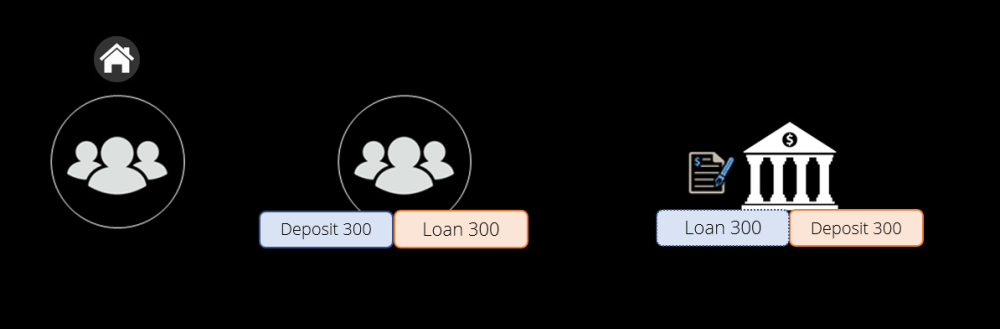

This is how money is created: A borrower goes to a bank to borrow money. The bank and the borrower sign a loan contract, which states that the bank will loan the borrower 100,000 dollars. The bank writes onto its ledger that it now owns a loan contract, market value of $100,000. The bank then writes into its ledger an 'Account Payable' of $100,000 and labels it deposits. That's it. $100k of freshly printed private bank money.

-

Everyone just be glad they don't own property in Canada:

-

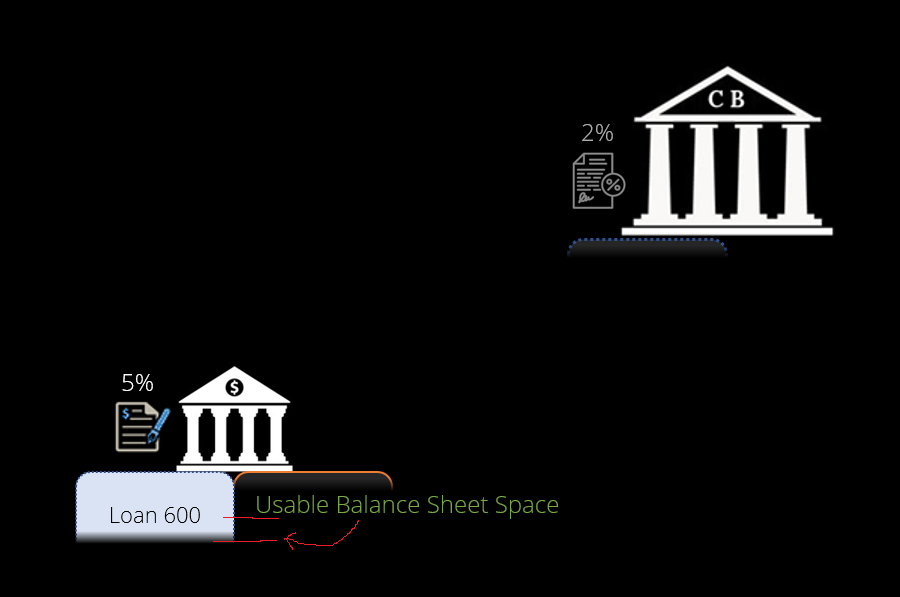

Nothing about liberalism is compassionate. Treating individuals as labour inputs cannot be compassionate given basic properties of a human being, like family, community. CA purposefully under supplies housing because they don't want to live in a populated area. They don't want coastal CA to be like Hong Kong. If you mean that low interest rates drives up housing prices--yes, it does. But ultimately banks create the money they issue to home buyers, so house prices reflect whatever banks are willing to create. That's accounting convention--houses are priced according to comparables rather than some other metric, which produces a pro-cyclical dynamic: the more banks lend, prices go up, the more collateral prices go up, the more banks can justify creating money (larger loans). When the income of households fails to cover the interest burden, households take on short term debt to pay off their interest burden, which makes the system more susceptible to short term changes in interest rates. But the bubble dynamics of housing are much more complicated than that today, because the financial instruments themselves (MBS) serve as collateral for other money creation. A house of cards within a house of cards within a house of cards. This is why the Fed has placed itself in as a dealer in money markets via the Standing Repo Facility and Bond Purchasing program. Its has woven a web of interrelated debt structures which everything depends on but can't sustain itself. This is why @Lord Ratner is talking about there being 'too much debt', which is generally correct but an oversimplification--the wrong kind of debt (the wrong kind of money). Debt is money. You can't just reduce debt, that reduces money--the deficit reduction we see happening now may reduce the money supply far below the required amount needed to sustain the private debt structure.

-

-

I think people misunderstand that CA natives don't want people moving there, and they use their legal system to intentionally restrict housing, driving up home prices to increase their own wealth, and make the people moving to the state miserable in the hopes they will some day go home. And it's working, inflow to CA was negative for the first time last year. Honestly, CA natives just want to go back to a state of 1900's rural beach property and empty land.

-

What is a mother paid for her product, the child itself? Nothing. Keep in mind that this output is the source of all future output, but women aren't compensated for it. Mothers are not paid for that labour. Do you pay your wife a wage, according to a contract, and does she negotiate her wages with you, subject to terms of law? This is not a reference to the southern US. Slave economies were the basis of social organization for thousands of years, beginning before the Sumerians themselves. This is our point of contention--if banks do not print dollars, where does money come from? Who/what creates the money supply today? What is the process? This is classical monetary inflation (too much money chasing too few goods) and this was refuted by the Fed. Inflation is not just a monetary phenomenon, and supply is not the only factor contributing to price changes. The paper is linked earlier. The platinum coin denominated as $1T would be produced by the mint and purchased by the Fed. The Fed would mark up the TGA by $1T and put the coin in a glass case on the wall. This is Rohan Grey's PhD paper, the source of this discussion topic, it's worth a read. Not sure how this relates to the financial system as it exists today. Similarly I don't think this would pass for a sufficient explanation of an aircraft system today either. Yes. The bank balance sheet expands, liabilities are created, those liabilities can be used for making payments. A loan is a legal contract, and exists within a legal system. All the effects and dynamics of law apply. The underlying collateral, if there is any, as private property, rights to use of property, all are affected. The IMF makes lots of dollar denominated loans to states that can't create dollars except through exports or asset sales that it knows won't be repaid, those loans have binding legal properties which are then wrought upon the debtor state--and that debtor cannot call the IMF and say 'hey, this isn't a loan sorry'. The US Gov won't 'pay back the debt', because in accounting terms that doesn't make sense. So long as someone has a desire to save, separate of the desires or behaviour of the private sector, the gov is the only entity which can swap an interest bearing note for those deposits. This is covered in detail via the animated slideshow linked earlier in the thread (screenshot above). If we trace the unit of currency through the financial system, the answer to your question becomes self-evident. You don't have to hear it from me. Here I think you mean that liabilities are being created and the corresponding asset has no market value. Or, in the case where the bank has positive equity, it can write liabilities to its ledger and create money--its not purchasing a loan contract from a borrower, its using the empty space on its balance sheet created from past loans and other loans (assets) currently on its books. Indeed, the deferred asset the Fed is creating right now demonstrates that money does not always need to be a loan, the Fed is just marking up its liabilities and assets without any contractual obligation applied to any human being. It's literally risk-free money for banks created from nothing. If you repay all loans, right now, using existing deposits, what happens to the money supply?

-

But I'm not sure you and I are using the word Liberalism the same way.

-

@Boomer6 If you don't like one of my posts my feelings will be hurt. 🤣

-

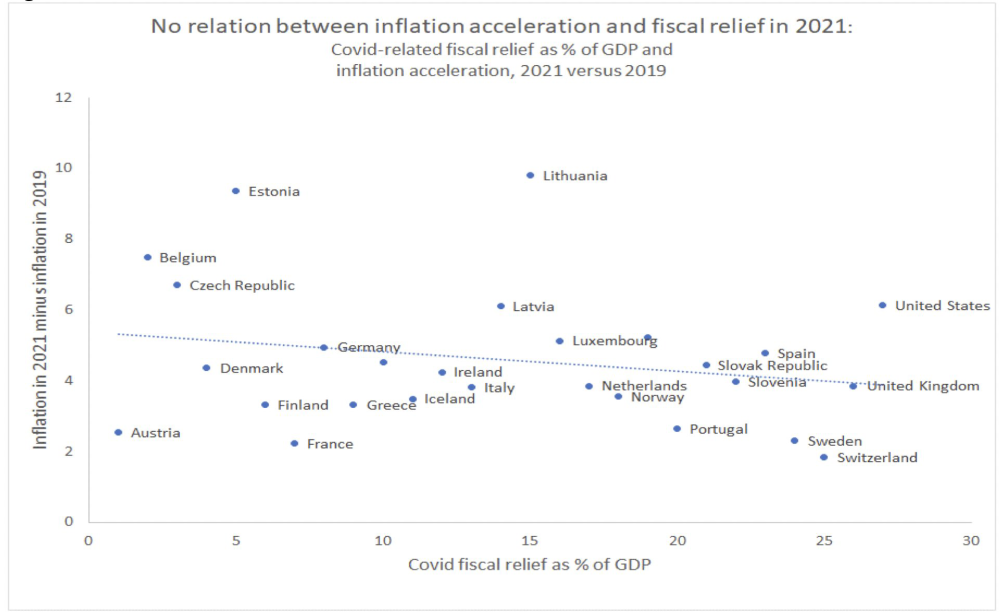

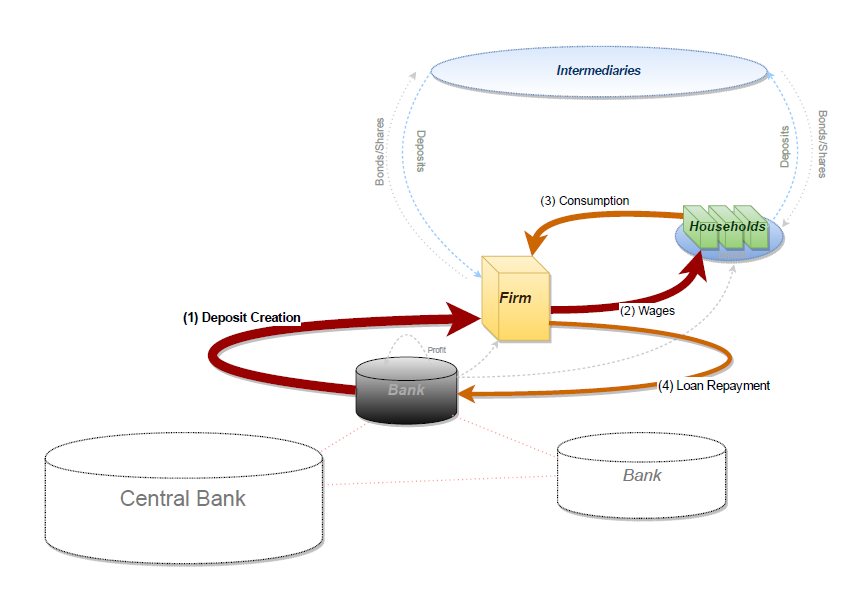

The Fed has a mandate to control prices, but asset prices aren't included in that mandate. The Fed inflates asset prices, intentionally. Again, I'm not saying the Fed is good or bad, I'm trying to get at a good description of money creation in order to trace its path through the system, we're just trying to identify where the fuel comes from in the first place. And the Fed is one component of money creation, when it marks up the accounts of its account holders, who are banks. The private banks themselves create most of the money supply. Ok, here is a claim we can test. When a bank issues a loan, such as an investment bank, it would be interested in recouping the loan [principle + interest (risk) + inflation (expected)]. So any bank loan (money creation) would have included in it an adjustment for the inflation associated with not just this loan, but all loans, over the respective period of time. Is this adjustment for the change in total private bank lending over time (typically referred to as a 'credit impulse') reflected in bank loan documentation? Not that I am aware of. We can also look at the change to CPI or CPI + asset prices when defaults rise, because defaulting loans means that the corresponding destroyed money is never destroyed. During periods of cascading defaults (firesales) does the CPI or asset prices rise? No, typically both decrease. Next we can think about it from the perspective of a single loan for a business that purchases only labour, a single 'monetary circuit' (Graziani, pictured below). #1, the bank creates deposits for the firm, #2 the firm pays workers... [If all money is always inflationary, are workers wages rising? The wage contract is typically agreed to and fixed prior to payment]... #3 Workers buy and consume the output... [If all money is inflationary, are the prices for the produced goods increasing? I don't believe so, firms typically set prices equal to costs plus a markup and don't respond to immediate changes in demand. Plus, any inrease in prices means an inrease in inventory, which would mean losses for the firm and default because the workers don't have enough money to pay increasing prices for the output, they would need additional loans from the bank]... #4 The firm repays the loan destroying the money created by the bank. Where in this circuit are prices changing because 'all money is always inflationary'? Please see the chart I posted above, which shows the response of CPI to Fed QE operations (no correlation). I agree that the Fed causes a change in lending behaviour, and you are spot on about that increasing 'moral hazard' and potentially 'misallocating resources', and that the asset price inflation will likely reverse if the Fed attempts to unwind QE which is happening now. These are valid points--and I'm not trying to antagonize you, I like your analysis--but I want to purge from it a reliance upon commodity money first and foremost. Banks create money, gov and private banks, and they are the decision makers about where the path of our economy leads (what we make, what we consume, where its made, etc). And this is not neutral <-- not just some function of the highest rates of perceived return, but subjective decisions of imperfect people with power. I don't understand what you are trying to convey here. When I purchase milk at the store, I am receiving productivity because I am paying with money. But if someone gives me the same milk, I am not receiving productivity because no money is involved? In the case of 2LT copypaster the increase in productivity doesn't do anything to the price for his labour. His wages don't go down as a result of his productivity increase. Regardless, we don't need a theory of prices or inflation in order to trace a unit of currency through the financial system. We only need to agree on the origin and substance of money in the real world, which today comes from a bank and resides on bank ledgers digitally. Well, the Fed is not authorized politically to disburse deposits to households. They are fully aware of the impact of QE on asset prices, that was Bernanke's stated intention ('wealth effects'). But at the very least your statement here is agreement that bank money creation is not always inflationary--in the case of QE an equal amount of reserves was not destroyed, the Fed added reserves and has not taken them out yet. I think you must concede this point, and I will re-reference this chart, which shows Fed QE yoy change correlation with CPI change (no correlation of Fed printing to CPI): COVID reduced productivity, and reduced (constrained) supply through unforeseen bottlenecks, which has contributed to inflation in goods and services. The impact on globalization is unclear, but your speculation may be correct. But the 'irresponsible money printing' here is unclear--all money is printed, what makes some money responsible and some irresponsible? Again, genuine question, and keep in mind that banks regularly create money for increasing future output, in other words, that output doesn't exist today for purchase. And this is where I want to get to. Neoclassical economists do not have an empirically valid theory of inflation. Post-Keynesians do. And I posted about this earlier in the thread--the Fed paper which acknowledged Post-Keynesian theories of inflation and money. When we say that the central authority doesn't understand--THEY DO UNDERSTAND. They just want something very different from you, and they are getting what they want. Not just too much debt, too much debt which won't be repaid--unproductive debt. And, a big part of that is housing debt. Any debt which does not increase income is technically considered unproductive. All mortgage debt, consumer debt, is by that definition unproductive. Remember, when you say 'Keynesian' you are specifically referring to the school known as 'New Keynesianism', which isn't based on the works of Keynes! It's based largely on the work of Hick's and Solow, and known as Neoliberalism, a resurgence of classical economic ideas from the 18th century. The idea that money is an exogenous commodity. F--- the academics mate. Private debt levels and repayment capacity of constrained balance sheets matters. That's the point of all this. Everyone here needs to know how the system actually works. Trace the drop of fuel through the machine, trace the unit of bank money from creation to destruction--that way people can decide for themselves what policy is the best way forward.

-

Ok, we're approaching our target I think. Taxpayer money, government spending beyond its means. Inflation, energy reliance/inflation. Remember, I live in the EU, so I don't really care what domestic policies AOC (or anyone else) is proposing, it doesn't affect me. What I am trying to figure out is why people in the US are shouting the equivalent of 'Your my fav big booty Latina' over and over to one another, rather than holding a useful dialogue and trying to form a team. What are the real differences that are dividing people? Can you get a cross-dressing faggot and a gun-toting redneck onto the same team? What policies would that team be based on? Can a decentralized framework of 'live and let live given large open undeveloped geographic space' work? Or is it that we need to purge a large group of people in fire first, and there really is no alternative? This leads us to prices--and we should really be over in the Finance thread, but I'll leave it here for now. First off, oil companies love high oil prices. US shale oil requires higher unit prices than almost anyone else, because the oil is more costly to extract. If you reduce oil prices below their costs, they close those wells. Generally, you need prices to be stable, and the Fed just gave the Dept of Energy to ability to act as 'shock absorber' via the futures market, guaranteeing future prices for oil producers. This ensures wells stay open and are less subject to speculative attack from outsiders like OPEC. Regarding Europe--remember that the US produces too much oil for its domestic market, and part of the conflict in Ukraine is about pushing the EU from Russian oil onto US natural gas. In other words, the US needs markets to sell its oil products, or the price of domestic oil crashes and the gov must absorb huge amounts via stockpiles (assuming it wants to keep domestic wells open). EU energy independence is bad for the US. More importantly however, is that energy transition to other sources (whatever they may be) requires energy. So exisiting energy production isn't going anywhere. What is going to have to change is the total level of consumption--we need to shift energy use from what we do now towards producing more energy sources that don't create GHG. If you don't think climate change is a thing, then you can ignore this (YOLO) and spend on something else. If you don't want the gov to spend on anything at all, do that. But this bring us to the actual topic at the heart of disagreement I think: HOW DO WE PAY FOR THINGS. And people get really worked up about this. But bankers don't. Bankers know they can always fund anything so long as the resources are available for purchase.