-

Posts

1,051 -

Joined

-

Last visited

-

Days Won

17

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Posts posted by nunya

-

-

52 minutes ago, abmwaldo said:

I haven't figured out how to auto update yet.

Watchtower.

I'm running generic Ubuntu, not Synology, and it looks like Synology might require a few extra hoops, but apparently it can be done.

https://mariushosting.com/synology-30-second-watchtower-install-using-task-scheduler-docker/

-

1

1

-

-

I like how you use 300k as your example on which to base your math. Of course if you low ball it or use new hires, your math looks right.

300k is an 82 hour monthly average for a WB FO or 69 hour monthly average for a NB CA. 82 hours is hardly hustling or playing the games and 69 hours is coasting (not that there’s anything wrong with that!)

But man, you do you and keep training those financially illiterate pilots.

-

4 hours ago, Lord Ratner said:

Edit: I looked it up, and the annual compensation limit for 2024 is $345,000.

At 17% that limits the company contribution to $58,650. Well below the $69,000 cap ($76,500 if over 50).

Except... Compensation in a Safe Harbor plan does not include bonuses, like profit sharing, which has been good for us post-COVID and pays the same 17% into your 401k.

A healthy, pensionable profit sharing check can make up for the under 50 crowd, and even for the over 50 crowd if they're playing the game well. I'm not saying everyone can reach these levels, but it's certainly not unheard of and will be more common when co contributions go to 18%.

QuoteBut this does nicely demonstrate just how financially weak a lot of the pilots are. I've had to correct many people on that misconception.

BTW, nice attempted flex. You were so, so close to the knock out.

-

2 hours ago, Lord Ratner said:

I have always wanted to get the statistics on how many airline pilots make zero contributions, and just rely on what the company puts in. Seems crazy to me, but at this point I bet it's at it's at least half.

An average CA or a hustling FO at a major with ~16-19% company contributions doesn't have to contribute a dime to reach IRS maximums by Thanksgiving, so I think you'll find plenty that don't contribute from their paycheck to a 401k.

The question would be how many are not socking way with IRAs, HSAs, 529s, brokerage, crypto, Cubans (the cigars, not the bipeds), or gunpowder and lead. I suspect that number is near 0.

-

8 minutes ago, SocialD said:

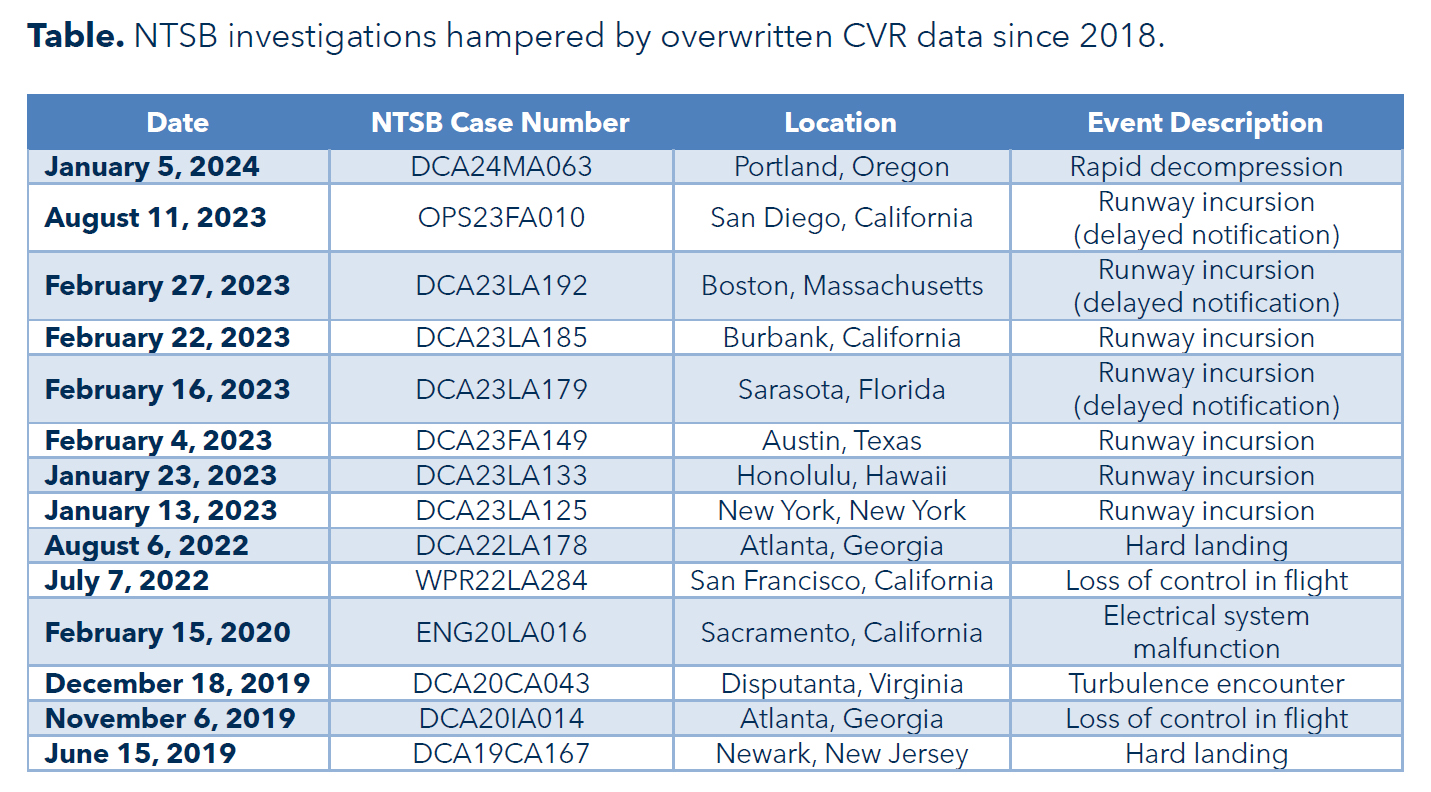

We already have something like 6-9 hour CVRs, what is going to 25 going to change? I guess someone may hear my ramblings on how to best exploit the contract to get the most pay for the least amount of work.

I don't know how I feel about the change, but it's a response to their inability to hear audio from AS1282 (the holy 737) and others. 1282 only had a 2 hour CVR.

-

Just now, Lord Ratner said:

Awesome, thanks. This will simplify my life

Yep. I've been buying SPRXX every pay day and had various auto transactions set up. No more need for those extra brain cells in a few weeks!

-

1

1

-

-

2 hours ago, Lord Ratner said:

Got a link to the jun 15 change on the sweep? Thanks for the heads up, I'm going to get this set up

I first saw it in the official Fidelity reddit from their customer service people. It's also on your March CMA statement in the Additional Information and Endnotes:

QuotePlease note that on or around June 15, 2024, you'll have the option to elect Fidelity(R) Government Money Market Fund (SPAXX) as your core sweep investment vehicle. You will not need to take any action if you wish to retain the Bank Sweep as your core position...

-

1

1

-

-

1 hour ago, Herkdrvr said:

Do serial numbers elevate the number of solved crimes though? And if so, by how much?

0% if they're filed off as they often are once they enter the underworld.

I looked for a stat about how many guns used in crime have altered/removed SNs, but I couldn't find anything.A decent number of guns are already untraceable because they have altered SNs.

Between 2017-2021, 48,601 guns couldn't be traced to a buyer because their SN was altered. 25,904 crime-linked guns traced back to a .gov owner!

Opposition to un-serialized firearms is not about crime prevention - it's simply about placing obstacles and red tape between citizens and legal firearms and creating the groundwork for a future confiscation database.

-

2

2

-

-

24 minutes ago, Khruangbin33 said:

Genuinely curious...in what ways? I've just been auto-buying a target date fund and ignoring it, plus a few brokered CDs for the hermit hut fund, so I don't have many interactions with the institution/platform.

Vanguard was outstanding, as long as I didn't need anything from a human. I was happy with them for many years, until...

My specific experience was needing to move 6 figures out of my brokerage account. It was too much to move online so I had to call. I waited on hold for cumulative hours over several days. I was completely unable to move the money before a deadline. Luckily another party covered for me while I moved the money out in several installments, staying under the online maximums.

I talked to others with similar experiences. I already had a good chunk at Fidelity and had never waited more than a couple minutes for a rep, so I bailed on Vanguard. I was probably hasty, but I don't regret it one bit.

-

1

1

-

-

Back on the personal finance front... Fidelity will allow SPAXX as your sweep account in Cash Management Accounts (CMA) starting around June 15. IMO this makes CMAs a no brainer. No need to mess with separate online savings accounts to get higher rates on your cash.

I know this took me a while to wrap my head around and I wish somebody had broken it down for me earlier, so for those that don't habla CMA, here's the skinny...

- CMAs are brokerage accounts that operate "like" checking accounts. Debit cards, ATMs, fee reimbursement, checks, online bill pay, direct deposit, etc.

- Your cash balances by default are kept at various banks around the country. You can see which banks, but there's no reason to care. You get FDIC protection, ~2.7%* interest, and manage your cash centrally via Fidelity.

- If you elect to keep your cash in SPAXX, you give up FDIC coverage, but you can get ~5%* on your cash balances.

- Vanguard just started "Cash Plus" accounts to compete. I'm sure they'll be great accounts, but I moved from Vanguard because (IMO) their service starting slipping around 2020 and became untenable.

- Bottom line, especially for the young dudes: Look beyond USAA for your banking needs. With some work, you'll be very wealthy one day - learn to manage it well now.

*all rates are as of 4/15/24

-

1

1

-

3

3

-

1 hour ago, pbar said:

I thought some Army space units were subsumed into the USSF. Probably one of those folks.

Nope. USAFA dude. While I find Ranger school weird for him, too, he had a helluva resume even before Ranger school (except for the UPT quit/washout part).

-

1

1

-

-

On 3/26/2024 at 6:41 AM, SocialD said:

Consider yourself in the presence of greatness. We may not have seatback in-flight entertainment, but at least our wifi sucks!

Satellite wifi on the way. No shit.

-

On 3/18/2024 at 2:20 PM, bs98 said:

Going to an airlift unit that has ample opportunity to go full time. I'd like to hear what a day or week in the life looks for an LT, specifically what happens when not flying.

Did they say "full time" or "AGR?" Technician/temp tech and AGR are very different pay scales and cultures.

-

1 hour ago, mcbush said:

Any words of wisdom? Mostly just curious if y'all would dig in or just crack a beer and forget it.

If your rep guy says leave it alone, I'd leave it alone. Not worth the gray hairs. And I'd quit posting mloa on my off days. Unless you're removing yourself from something or blocking something, the company doesn't need to know when you do mil.

-

3

3

-

2

2

-

-

11 hours ago, nsplayr said:

Airmen Development Command

I had to google to see if you were kidding or not. Not, I see.

QuoteThe ADC redesignation will pave the way for an expanded, people-focused footprint that will help the Air Force posture to rapidly adapt training programs and curriculum, produce mission ready Airmen at an accelerated rate, and develop human capital in a holistic manner conducive to retaining talent.

Wow. Who knew changing the letterhead was so damn powerful! Imagine what they could accomplish if they changed the font, too!

Also, this was a perfect chance to make it Airpeople!

-

1

1

-

-

4 hours ago, kaputt said:

You shouldn’t have to submit your LES to get points. I schedule everything through UTAPS and as soon as my supervisor approves a worked IDT in UTAPS it gets submitted for pay and points. I’ve never had an issue with the points or pay not showing up.

Oh I've had plenty of UTAPS points not post to PCARS. They had an entire newsletter about it. Hopefully it's fixed and doesn't reappear but definitely don't trust them! https://www.hqrio.afrc.af.mil/RIO-Buzz/Vol-34/

-

55 minutes ago, Lord Ratner said:

Lol, exactly. Forgetting to turn off the anti-ice for 5 minutes and you get a total engine failure? That's the definition of a "real shocker."

-

4

4

-

-

11 minutes ago, gearhog said:

why would we allow anyone to see dangerous misinformation?

In a better world, the viewer would analyze the speaker and the message and judge accordingly. You think most of what's broadcast domestically is not propaganda and misinformation? You think most of what Trump or Pelosi or Biden or the squad chicks say is truth? I think it's a perfect opportunity to sit down with your kids (or great-grandkids, CH & Huggy) and talk about critical thinking.

-

3

3

-

-

5 minutes ago, fire4effect said:

I guess looking at part 135 NTSB accident reports might shed light on potential age related causes. Or other countries with increased limits.

I don't think an honest comparison is possible. If someone does try to study it, I think you'll just find deductive reasoning supporting a preconceived conclusion.

There are way too many variables with Part 91/135 vs 121 operational risk, maintenance schedules, rest, recency, multi-model qualifications, single pilot vs crew, etc.

-

11 hours ago, Lord Ratner said:

For personal funds, sure, for leveraged investing that's a different story.

You're really taking this leveraged thing seriously. The dude's not taking out a second mortgage for a million and risking his house. It's a piddly $25k. It's an excellent way to start a nest egg towards the elusive first $100k. Yes, it's leveraged, but it's going to be $450 a month, FFS. A couple maxed out IRAs and a bunch in FZROX at 22 for $450 a month? Yes, please.

-

Gents, before this gets derailed too far, @Lord Ratner's point is not invalid. He's assuming you will pay the loan payments with the loan capital. Everyone else is assuming you pay the loan back with fresh paycheck money.

I'm in the latter camp because I think even as an Lt, you should be able to scrape together $450 from your paycheck and let the loan money sit for the long term untouched. You shouldn't NEED that loan capital to pay the loan payments. It should be locked away somewhere (i.e. 2x maxed Roths + the rest in a brokerage account, although I'm more of a VTSAX man, myself).

If you will NEED the loan capital to make the loan payments, then yes, put it in HY savings and make a few dollars on the difference.

-

1

1

-

-

On 1/29/2024 at 4:28 AM, StrikeOut312 said:

Max your Roth IRA this year too.

And last year.

-

2

2

-

-

I thought this was interesting. I never bothered to look at doors that closely.

-

That's simply horrendous reporting. I know I shouldn't expect anything, but wow.

-

2

2

-

single vrs. married/ dating

in Military Spouses

Posted · Edited by nunya

They can also be an incredible ally in one of the hardest years of your life. Certainly I've seen them be a drain - and that couple usually ends up divorced. My wife of 20+ years was with me before and through UPT and she made my life during training infinitely easier and more comfortable. She also found a part time job so she wasn't cooped up in the house all day just waiting on formal release.

To CaptainMorgan's point... we weren't complete newly weds and it would have been more shocking to go from honeymoon to UPT in days instead of months.

That's fine. And I agree 100% - don't let your Tinder/Insta/Grindr/Bumble/Farmers Only flings distract you. But my only advice is don't be so closed minded that if the right one drops into your life that you ignore her for the wrong reasons.