-

Posts

157 -

Joined

-

Last visited

-

Days Won

2

Marty - Trident Home Loans last won the day on April 12 2018

Marty - Trident Home Loans had the most liked content!

Contact Methods

-

Website URL

www.tridenthomeloans.com

Profile Information

-

Gender

Male

-

Location

Pensacola Beach, FL

Recent Profile Visitors

4,517 profile views

Marty - Trident Home Loans's Achievements

Crew Dawg (2/4)

42

Reputation

-

SpencerTHL started following Marty - Trident Home Loans

-

Definitely a pleasure to work with you again and help your family save money! Thanks for the shout out and the repeat business! We try to do the best by all our clients! Have a great Christmas and 2021! Yes VA jumbos streamline refi's are still holding at 2.25%. The VA requires a 210 day season period from your first payment to the earliest you can close on a refi. We can start about 30 days prior to that. Just give me a ring/put an app in for the refi and I'll run the numbers for you. App link Cheers! Jon 850-377-1114

-

Good question: no, just conventional refi’s bought by Fannie Mae and Freddie Mac. Ginnie Mae buys all the Gov loans. For those who aren’t tracking, Fannie and Freddie hit the conventional mortgage market hard last week with an unexpected fee that wasn’t priced into rates. I think conventional rates will recover but it’ll probably be at least 30 days for the industry to adjust to the new norm. http://www.mortgagenewsdaily.com/consumer_rates/952069.aspx Marty Sent from my iPhone using Tapatalk

-

Caliber is a good servicer. We mostly do our servicing through United Wholesale Mortgage, Caliber, and Home Point Financial. Haven't ever heard any issues with any of them. We have account executives with all of them that we can reach out and touch if any of our clients are having any issues even after we transfer the servicing rights. They want our business so that gives us leverage. We don't service any of our loans...too small of a company for that. Marty

-

I'd look through any and all documentation you received from both NBKC and Freedom or ask them to provide you copies of what they sent you. There are legal rules set forth by the Consumer Financial Protection Bureau that cover mortgage servicing transfers. If you didn't get the Notice of Servicing Transfer from both parties within the legal time frame then you can file a complaint through the CFPB and hopefully the credit bureaus will remove the hits as well. Good luck...sorry you're having to deal with this. https://www.consumerfinance.gov/policy-compliance/rulemaking/regulations/1024/33/#b-2-i-C Marty

-

Thank you! We're excited to add AZ! We've been working hard to get that license for a while. AZ is a cheap refi state so I'd imagine we can do no cost even below 3.375% right now. Put an app in on our website and put baseops in the referral source and we'll get you a quote. Marty

-

Not an issue if your office is in the FL Panhandle...we have a few folks from lower Alabama working for us...problem naturally solved itself👫

-

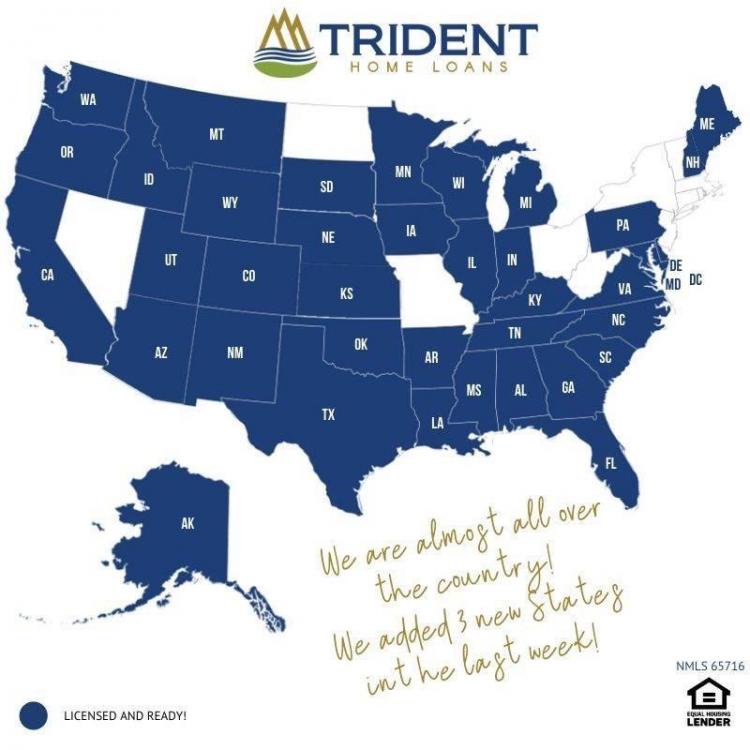

Very excited to let you guys know that we are rapidly expanding the states we are licensed in so we can better serve your needs. Let Jon or myself know if we can do anything for you. Thank you for the loyalty and trust you've placed in us! It's truly an honor to serve such an amazing group of service members! Marty

-

Happy New Year from all of us at Trident! We had a great 2019 and were able to help about 150 of you either buy a new home or lower your monthly payment. You are our prime clients and we will always give you the best rates and service in the business. I've expanded Jon's team so you get even better service, and unlike the rest of the mortgage industry, we haven't raised our profit margins during these historically low rates. We're excited for the improvements to the VA loan program in 2020 and the opportunity to help save more of you money! Highlights are: 1) Historic low rates 2) No county limits on loan amounts if you have your full VA entitlement 3) Increased county loan limits if you want to keep your current loan and still get a second VA loan 4) The VA expediting disability claims to help veterans avoid the VA funding fee Lastly, a big thank you to all of those who are helping spread the word about Trident! Based on competitors quotes that are shared with us, we're trending .25-.5% lower on VA rates and $300-1000 less in lender fees. With your help we have been revolutionizing the business and exposing the greed of the big name banks/lenders. Keep it up! Have a wonderful 2020! Marty Owner, Trident Home Loans 757/767 Captain, Former EA-6B pilot, USNA grad

-

Stay tuned on new Trident state licenses. We’re working aggressively to get licensed in all 50 states and will be announcing new states soon. Sorry we couldn’t help you on this one but glad Amy took good care of you! Marty Sent from my iPhone using Tapatalk

-

Amy is correct. Sorry for the confusion. Lots of difference guidelines on programs out there and Jon is tracking where he went wrong. Agree that the best thing is to wait on the new guidance to be released. Marty Sent from my iPhone using Tapatalk

-

Hey, absolutely happy to help! We also enjoyed working with you last time around. Drop Jon an e-mail or call when you have some time with. Just need to know what the plan is for your current home, what airline you're going to and their training pay, when you start class, when you expect all the background checks done, when you finish terminal, if you're doing the reserves, if so how much you're thinking you'll make, credit score, monthly debt obligations, and cash available. Don't need to pull credit or anything at this point unless you want us to. We do a lot of loans for folks who are transitioning and we can come up with a good plan for you. It's smart that you're thinking about this now. Jon's info is 850-377-1114 or jk@mythl.com. Cheers! Marty

-

Spot on. All you need is a statement of service letter from your CC stating your projected income. Previous income will still be verified but a statement of service letter is the end all be all for reservists or folks separating who don’t have an income history in the reserves yet. Our underwriters understand that reservists income fluctuates. Jon is an AF reservist and our underwriters know that he understands reserve pay better than they do. You shouldn’t have an issue. Cheers! Marty 850-346-0250 marty@mythl.com Sent from my iPhone using Tapatalk

-

Crickets so far. I heard 1 Jan 20 for the effective date as well. There is a lot of guidance that needs to be hashed out and published still. Marty Sent from my iPhone using Tapatalk

-

The VA issues you a certificate of eligibility (COE) based on your service history used to qualify you. When applying for a COE you list your component (AD, Reserves, or Guard) along with dates of service. You then may need to provide supporting documentation (ie. statement of service letter from your CC or a proof of service letter from vMPF) if the VA doesn't already have the documentation in their automated system. Your funding fee will then be based off the COE they issue. There is an entitlement code on the top left of the COE which is typically 5, 10, 11. 11 is someone who earned it through the reserves and 10 is active duty. If you're an activated reservist on title 10 orders (not for training) you can get qualified using the active duty funding fee if you meet the criteria. (2yrs or 90 days wartime/181 days peacetime) The VA uses manual M26-1 Chap 7 to determine how you've earned your entitlement which goes into a lot more detail on the subject. It's worth reading to save the money if you think you qualify. Your lender can go into the VA system and submit a correction for you. https://benefits.va.gov/WARMS/docs/admin26/m26_01/CertificateofEligibilityandEntitlementFINAL.docx Might be a red flag if you have to teach your broker how to do a VA loan though. There are a lot rules/processes on VA loans which might bit you later if your broker doesn't know what he/she is doing. Good luck! Marty

-

Great to hear! Thanks for the feedback! Marty