-

Posts

157 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Everything posted by Marty - Trident Home Loans

-

Definitely a pleasure to work with you again and help your family save money! Thanks for the shout out and the repeat business! We try to do the best by all our clients! Have a great Christmas and 2021! Yes VA jumbos streamline refi's are still holding at 2.25%. The VA requires a 210 day season period from your first payment to the earliest you can close on a refi. We can start about 30 days prior to that. Just give me a ring/put an app in for the refi and I'll run the numbers for you. App link Cheers! Jon 850-377-1114

-

Good question: no, just conventional refi’s bought by Fannie Mae and Freddie Mac. Ginnie Mae buys all the Gov loans. For those who aren’t tracking, Fannie and Freddie hit the conventional mortgage market hard last week with an unexpected fee that wasn’t priced into rates. I think conventional rates will recover but it’ll probably be at least 30 days for the industry to adjust to the new norm. http://www.mortgagenewsdaily.com/consumer_rates/952069.aspx Marty Sent from my iPhone using Tapatalk

-

Caliber is a good servicer. We mostly do our servicing through United Wholesale Mortgage, Caliber, and Home Point Financial. Haven't ever heard any issues with any of them. We have account executives with all of them that we can reach out and touch if any of our clients are having any issues even after we transfer the servicing rights. They want our business so that gives us leverage. We don't service any of our loans...too small of a company for that. Marty

-

I'd look through any and all documentation you received from both NBKC and Freedom or ask them to provide you copies of what they sent you. There are legal rules set forth by the Consumer Financial Protection Bureau that cover mortgage servicing transfers. If you didn't get the Notice of Servicing Transfer from both parties within the legal time frame then you can file a complaint through the CFPB and hopefully the credit bureaus will remove the hits as well. Good luck...sorry you're having to deal with this. https://www.consumerfinance.gov/policy-compliance/rulemaking/regulations/1024/33/#b-2-i-C Marty

-

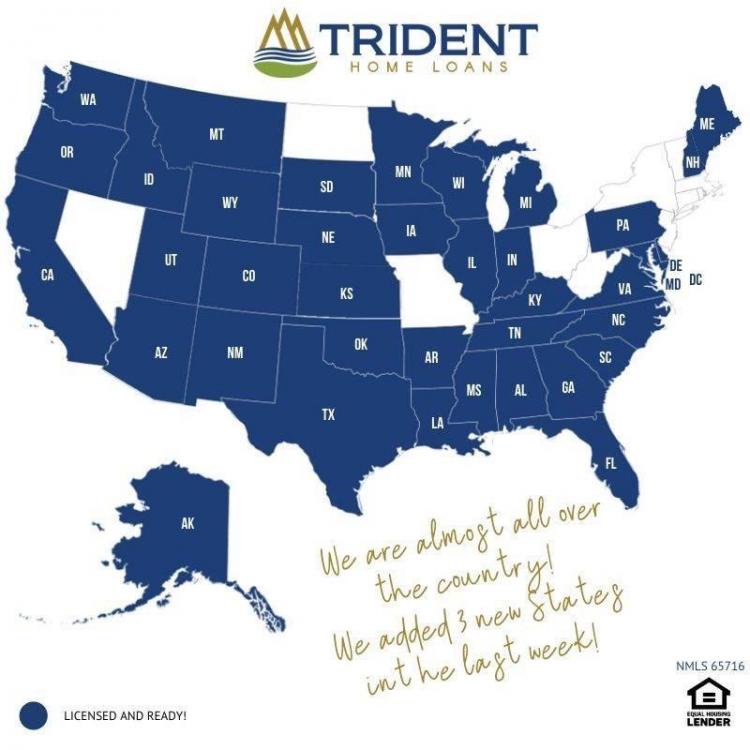

Thank you! We're excited to add AZ! We've been working hard to get that license for a while. AZ is a cheap refi state so I'd imagine we can do no cost even below 3.375% right now. Put an app in on our website and put baseops in the referral source and we'll get you a quote. Marty

-

Not an issue if your office is in the FL Panhandle...we have a few folks from lower Alabama working for us...problem naturally solved itself👫

-

Very excited to let you guys know that we are rapidly expanding the states we are licensed in so we can better serve your needs. Let Jon or myself know if we can do anything for you. Thank you for the loyalty and trust you've placed in us! It's truly an honor to serve such an amazing group of service members! Marty

-

Happy New Year from all of us at Trident! We had a great 2019 and were able to help about 150 of you either buy a new home or lower your monthly payment. You are our prime clients and we will always give you the best rates and service in the business. I've expanded Jon's team so you get even better service, and unlike the rest of the mortgage industry, we haven't raised our profit margins during these historically low rates. We're excited for the improvements to the VA loan program in 2020 and the opportunity to help save more of you money! Highlights are: 1) Historic low rates 2) No county limits on loan amounts if you have your full VA entitlement 3) Increased county loan limits if you want to keep your current loan and still get a second VA loan 4) The VA expediting disability claims to help veterans avoid the VA funding fee Lastly, a big thank you to all of those who are helping spread the word about Trident! Based on competitors quotes that are shared with us, we're trending .25-.5% lower on VA rates and $300-1000 less in lender fees. With your help we have been revolutionizing the business and exposing the greed of the big name banks/lenders. Keep it up! Have a wonderful 2020! Marty Owner, Trident Home Loans 757/767 Captain, Former EA-6B pilot, USNA grad

-

Stay tuned on new Trident state licenses. We’re working aggressively to get licensed in all 50 states and will be announcing new states soon. Sorry we couldn’t help you on this one but glad Amy took good care of you! Marty Sent from my iPhone using Tapatalk

-

Amy is correct. Sorry for the confusion. Lots of difference guidelines on programs out there and Jon is tracking where he went wrong. Agree that the best thing is to wait on the new guidance to be released. Marty Sent from my iPhone using Tapatalk

-

Hey, absolutely happy to help! We also enjoyed working with you last time around. Drop Jon an e-mail or call when you have some time with. Just need to know what the plan is for your current home, what airline you're going to and their training pay, when you start class, when you expect all the background checks done, when you finish terminal, if you're doing the reserves, if so how much you're thinking you'll make, credit score, monthly debt obligations, and cash available. Don't need to pull credit or anything at this point unless you want us to. We do a lot of loans for folks who are transitioning and we can come up with a good plan for you. It's smart that you're thinking about this now. Jon's info is 850-377-1114 or jk@mythl.com. Cheers! Marty

-

Spot on. All you need is a statement of service letter from your CC stating your projected income. Previous income will still be verified but a statement of service letter is the end all be all for reservists or folks separating who don’t have an income history in the reserves yet. Our underwriters understand that reservists income fluctuates. Jon is an AF reservist and our underwriters know that he understands reserve pay better than they do. You shouldn’t have an issue. Cheers! Marty 850-346-0250 marty@mythl.com Sent from my iPhone using Tapatalk

-

Crickets so far. I heard 1 Jan 20 for the effective date as well. There is a lot of guidance that needs to be hashed out and published still. Marty Sent from my iPhone using Tapatalk

-

The VA issues you a certificate of eligibility (COE) based on your service history used to qualify you. When applying for a COE you list your component (AD, Reserves, or Guard) along with dates of service. You then may need to provide supporting documentation (ie. statement of service letter from your CC or a proof of service letter from vMPF) if the VA doesn't already have the documentation in their automated system. Your funding fee will then be based off the COE they issue. There is an entitlement code on the top left of the COE which is typically 5, 10, 11. 11 is someone who earned it through the reserves and 10 is active duty. If you're an activated reservist on title 10 orders (not for training) you can get qualified using the active duty funding fee if you meet the criteria. (2yrs or 90 days wartime/181 days peacetime) The VA uses manual M26-1 Chap 7 to determine how you've earned your entitlement which goes into a lot more detail on the subject. It's worth reading to save the money if you think you qualify. Your lender can go into the VA system and submit a correction for you. https://benefits.va.gov/WARMS/docs/admin26/m26_01/CertificateofEligibilityandEntitlementFINAL.docx Might be a red flag if you have to teach your broker how to do a VA loan though. There are a lot rules/processes on VA loans which might bit you later if your broker doesn't know what he/she is doing. Good luck! Marty

-

Great to hear! Thanks for the feedback! Marty

-

Amy gave some good info. I'd also add the VA to Conventional refi option. If you want to keep the house but still need to free up your entitlement you can refi it into a conventional loan and do a one time restoration of your VA entitlement once you close on the refi. You'd want to close on the refi before going under contract on the new house so you get the lowest rate (primary residence vs an investment property). You'd have closing costs on the refi but some states don't tax refi's so closing costs can be reasonable. If you're going to an expensive area (DC, Cali, etc) and think you'll need a jumbo loan (over $484,350) than freeing up your VA is the way to go. VA jumbo's require little to no down payment and our jumbo rates are super low compared to other lenders. If you don't need your full entitlement to buy the new place then I'd just calculate how much entitlement you have left and then bring the 25% difference of the purchase price - entitlement remaining. This could vary well be the cheapest option. I've attached a VA entitlement calculation example/worksheet. The simplest way to figure out what is the best move is to just give me or Jon a call. Happy to talk through any scenarios. Better to start exploring options well before you need to execute. Cheers! Marty marty@mythl.com cell: 850-346-0250 guaranty_calculation_examples.pdf

-

You’re not missing anything. Jon’s total interest was based off paying it off at 20yrs and not with a disciplined extra payment every month from the start. If you made the difference in principle payment from the beginning and never missed it then you are 100% correct. Most people are not as disciplined as a Marine to make extra payments diligently every month along the way. They throw lump payments in towards the end or randomly sprinkled throughout so they end up paying more in interest even though they paid it off in 20yrs. Getting the 20yr mortgage from the start forces the borrower to be disciplined but that’s not for everyone. You both are right, but as a former Navy guy I’ll side with you;) Marty Sent from my iPhone using Tapatalk

-

You’re welcome! Love to work with you in the future! I like Josh because his first quote is his best and he doesn’t play the used car salesmen game. About the most unethical thing I see in this business is lenders quoting high in hopes that the person doesn’t shop around and then when they do they say “well send me their quote and I’ll see what I can do” or “I’ll talk to Sr. management”. So the 90% who don’t shop around get screwed and the 10% get a quote that barely matches or beats by maybe a couple hundred bucks the quote of the ethical guy who was upfront from the beginning. I’ve been doing this for 15+ years and this exact scenario plays out like a record. When this conversation starts do yourself a favor and just run away. Any company that treats anyone, let along a veteran should be ashamed of themselves. Best quote upfront + great service = a great lender. That’s been Trident’s model since I started it and it’s not changing as long as I own the company. Off my soap box...let me know how it turns out with Josh. I only want to refer you guys to the best I can find in states we’re not licensed in. Marty Sent from my iPhone using Tapatalk

-

Only heard great things about Josh in AZ! Recently referred another baseops guy to him and got great feedback. Great service and a great rate. I’d definitely shop the loan with him. Marty Josh Goldberg Mortgage Planner Direct: 480-459-4516 Cell: 480-510-6350 EFax: 480-718-7980 Main office: 480-459-4500 Josh.Goldberg@barrettfinancial.com Sent from my iPhone using Tapatalk

-

Longest we do is 90 days and there is no cost to lock. 30-60 days locks typically give the best rate/pricing. Depending on the situation we can do a 90 day hedge lock and then float you down for free at the 30-45 day point if rates/pricing are better. Best thing is just to call us and talk through what you’re looking to do. Marty Sent from my iPhone using Tapatalk

-

Hey RASH, Have him give Jon a call or email. He’s our loan officer licensed in WA. We’re typically .25-.375 lower than the national average on conventional loans, but Jon can work up some specific rates for him. We’ll make sure to give him the best deal we can. Try to make it as painless as possible. Marty Jon: 850-377-1114, jk@mythl.com Sent from my iPhone using Tapatalk

-

Thank you Sir! Jon’s team devoted to our Baseops loans has been doing a fantastic job! Bri is incredibly knowledgeable and she’s always ready to fight for our clients! It’s a great time to get a mortgage with rates dropping due to the market decline. Also if you have a 4.5% rate or above you should consider seeing if a refi makes sense. Yesterday we started seeing 3.875% no points on 30yr VAs. We’re still sitting .375-.5% below all the big names doing VA loans. Cheers! Marty Jon’s contact info: jk@mythl.com Cell: 850-377-1114 Sent from my iPhone using Tapatalk

-

Just letting you guys know that the VA just announced the increase in the loan limit to $484,350 for any loan closing after 1 Jan '19 that we were expecting. That's just the standard limit and many counties have higher loan limits which you can look up here: https://www.benefits.va.gov/homeloans/purchaseco_loan_limits.asp You can still buy above the loan limit but you need to put down 25% of the difference between the limit and the purchase price. Also, if you're looking for some simple tricks on how to get a lower interest rate check out the article Jon wrote for the Dec issue of Aero Crew News (page 24) https://www.aerocrewnews.com/acn/2018/12-ACN-Dec-2018.pdf Enjoy the holidays! Marty

-

We’d be happy to help you! We’re .5% lower than the 2 biggest VA lenders in the country when I checked their websites on Fri. Give Jon a call (850-377-1114 or jk@mythl.com) and he’ll get you pointed in the right direction. Marty Sent from my iPhone using Tapatalk

-

Thanks for sharing Amy! I’m sure the VA will follow suit in the new couple weeks too. In addition to raising the limit it also gives you more buying power if you need a second VA loan. For example if your first VA loan was for $200K, you will now be able to rent your first property out and get a second VA loan on a new property for up to $284,350 with zero down. Same situation but you’re buying in a high rent district and the county limit is 726k you can get a second use VA for up to 526k with zero down. If the house costs more than the entitlement you have left then you just need to put down 25% of the difference between the purchase price and the entitlement you have left. Cheers! Marty Sent from my iPhone using Tapatalk