QAZqaz

-

Posts

41 -

Joined

-

Last visited

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Posts posted by QAZqaz

-

-

On 12/17/2021 at 7:00 AM, likearock1515 said:

https://the-military-guide.com/maximizing-your-thrift-savings-plan-contributions-in-a-combat-zone/

I don’t believe everything I read on the internet, but this article seems to be written by someone who has done their research. There’s a TON of fluff in it, and it is from a few years ago, so may not be 100% accurate, but I’m wary of what some folks have suggested up til this point regarding maxing your Roth ASAP.

Once you hit the elective deferral limit in your Roth, you may basically get locked out of any additional limit contributions, Roth or traditional. (You certainly won’t be able to contribute anything over 20,500 into your Roth) Also, any additional limit contributions have to be made while you are in the combat zone, so an “early” deployment won’t do you much good. The best way to work it, according to this article, would be to put $20,499 or less into your Roth, deploy long enough to dump 40,500 into the traditional side of your account, then put $1 into your Roth at the end of deployment or once you’re home. If you are in the BRS then you obviously need to plan/spread the contributions out to where you don’t hose yourself out of a government match towards the end of the year.

Bottom line, my interpretation of a third party article is that if you hit your elective deferral limit by contributing 20,500 into your Roth, you may get locked out of additional limit contributions, unless the TSP coding has been fixed from when this article was written. Hopefully it has been fixed, but it’s probably such a rare situation that I doubt finance or TSP folks could give you a 100% clear answer. Even if my interpretation of this article is wrong, you only potentially miss out on a small dollar amount in your Roth, which you can probably make up by the end of the calendar year.

Happy to hear any reattacks or real world experiences since I’ll be trying this myself this upcoming year. Good luck!

Yeah I read that one before. So my biggest concern is accidentally going over $20.5k and then it locking the additional annual limit ($40.5k traditional) out so I’ll just have to watch it on every paycheck and figure out what month I need to drop the percentage, then on the following month start dropping into the traditional.

-

On 12/10/2021 at 10:27 PM, SocialD said:

This is as good of place as any. Watch your TSP contribution limits because the TSP coders screwed up and it doesn't know to stop your contributions at $19,500 (2021). So it just continues to deduct money for your TSP. TSP is smart enough to only put in $19,500 and sends the rest back to DFAS. DFAS then has to cut you a check and you'll get it back in another pay stub. Problem is, this issue started back in August and the department that handles the refunds is, as the DFAS told me, "buried in a mountain of paperwork." He said it's a manual process, so don't expect that check anytime soon... Thanks bro, appreciate it! Yet another battle I spend my previous few days at work fighting, rather than doing my job. Oh well, they want to provide a shitty product, this is what they get.

I wonder if the system is smart enough to start dumping money past $20.5k into the traditional TSP if I am getting tax free on my pay stubs? Like after a few months I max the $20.5 and it sees I am in a CZTE and starts putting it into my Traditional TSP up to the $61k limit. This MIGHT be something the TSP people know but so far they've been basically unhelpful and always try to pass the buck to DFAS.

This I don't really wanna press to test though and will probably have to watch my mypay stubs every month to figure out the exact percentage for my last month in the Roth TSP to shack it just under the $20.5k limit and then set up the next month for the traditional Roth annual additional limit.

And yeah just the fact that DFAS and TSP have no idea how to answer my basic questions tells you something

-

On 12/10/2021 at 4:56 AM, ViperMan said:

I apologize, because I can't get into deep specifics regarding what happens in your situation. My knowledge is wide, but generally shallow.

https://militarybenefits.info/thrift-savings-plan-contribution-limits/

"The Elective deferral limit applies to the combined total of traditional and Roth contributions. For members of the uniformed services, it includes all traditional and Roth contributions from taxable basic pay, incentive pay, special pay and bonus pay but does not apply to traditional contributions made from tax-exempt pay earned in a combat zone."

"Service members cannot contribute $20,500 to each program. The limit indicates the amount you can contribute to one or both."

There is also this thing called the "annual" limit (i.e. where you see $61,000 referenced). This refers to all dollars added to your account - think of this as the contribution from your employer - which for us is bupkis.

//Break//

Put as much faith in this as how much you paid for it: I think the TSP is supposed to *fix* any errors you make regarding contributions. If you add too much, they just return the money to you. So if your goal is to max perform it, just pull as hard as you can and let HAL figure it out. Note: I have not ops-tested this game plan.

https://www.tsp.gov/making-contributions/contribution-limits/

Elective deferral limit: "This limit applies to the combined total of traditional and Roth contributions. For uniformed services members, this does not apply to traditional contributions from combat-zone pay."

To me, that sounds like you should contribute 100% of combat-zone pay to your traditional TSP, but only *if* you're going to reach the $19,500 hard-stop limit for 2021. If you can't - even with 100% of the rest of your pay going to TSP this year - I would just contribute all of it to the Roth TSP. No sense in paying taxes on tax-free income.

So your last paragraph is where I disagree on the execution. For 2022, the conclusion I came to was to max out my $20,500 in my Roth TSP by putting like 55% of my base pay into it, so I can get it finished in 4 months or so. Then after that is maxed out, I will use the annual addition limit to add another $40.5k into it before the end of the year. I will be receiving tax free for every month but December next year, so I think it's possible. The execution of it is the question.

I'm thinking what others have said about DFAS/TSP/mypay whoever tracks this stuff will see that I am getting tax free on my pay stubs and I am guessing I will be able to automatically get up to the 61K annual addition limit, but I will have to press to test.

This is all to say that I didn't realize one point: Had I known how this works, every time I got a monthly "tax free" on a mission, I was allowed to contribute to the traditional TSP beyond the $20.5k I put into my Roth TSP. So had I known that, I could have been dumping even more than $20.5k into the TSP every year I've flown missions overseas. That said, sometimes it takes a while for the tax free to hit my pay check, and when you edit your TSP contributions they take effect in the following month, so I don't know how to execute on that if the timing isn't perfectly lined up. Can you contribute to the annual additional limit the month after you receive a tax free?

And yeah this process is frustrating and shitty because nobody knows anything when you call, and it looks like I will have to monitor every single monthly pay stub to figure out when to cut the monthly contribution down so I don't go over my roth limit initially, and then my annual additional limit after that.

-

On 11/30/2021 at 1:43 AM, jazzdude said:

It's hard to max out to the 61k limit, since your TSP contributions are limited to your pay, unless you have good timing with a deployment and/or a bonus.

I was able to exceed the normal limit my last deployment (2019), though you need the tax free to be showing on your LES, as that seems to be the trigger that allows the extra traditional tsp contributions above the normal limit, and when the tax free goes away it stops your ability to add anything past the normal limit, even if you haven't hit the annual addition limit.

I also think that if you maxed out at the normal contribution limit, it made it so you couldn't contribute above the limit on deployment (like you noted), though I can't find that on the tsp website anymore. I set up my contributions to be under the limit when I deployed with a two month buffer to get the tax free processed.Thanks,

I think I have a shot at maxing it out. Good to know the LES tax free triggers it. Do you have to contribute to the Roth TSP up to $20.5k first or can you contribute to traditional initially? I will have a month where I will not be in a CZTE at the end of year and figured it might be better to contribute to Traditional TSP first, since apparently I can always contribute to the Roth up to $20.5k.

By normal contribution limit do you mean the initial $20.5k? Does that mean if I contribute $20.4k into a Roth that i am good to contribute $40k to the traditional, and that if I mess up and contribute $20.6k to the roth that it prevents me from contributing anything to the traditional? I know if you go over the money gets kicked back for the Roth, I just dont know if I am locked out of further contributions to traditional.

Viperman: I can find random stuff on what the contribution limits are WRT the amount for normal and additional contributions, but the execution of it is what I wanna get right that can't seem to be answered by anyone. Also, for example, lets say I contribute 50% of my base pay for the first 4 months of the year in Roth and I am stateside, and max out the $20.5k. If I fly into a CZTE in June, does that now mean that I can contribute an additional 50% of my base pay into the Traditional TSP for that month?

-

So I’ve tried TSP customer service, DFAS and myPers and nobody can explain to me how to allocate past the $20,500 for 2022. I don’t even know how many months I need to be overseas to max it, or if it’s prorated depending on how many months you spend overseas in a calendar year. Has anyone done this and if so how much can I contribute and how many months do I need to be overseas? What happens if I exceed the limits? Once I max the Roth TSP do I need to then reallocate into the traditional TSP or if I go a penny over the 20,500 allotment does it lock it out the traditional TSP? after hours on the phone I have no answers.

-

On 10/29/2021 at 1:11 AM, guineapigfury said:

I've been through this. Here is my experience from 2016. First the Air Force will offer you continuation (usually to 20) or not. If they don't offer, you will receive involuntary separation pay (assuming you did not write a "do not promote me" letter to the promotion board). If they do offer continuation, you can accept or not accept. If you accept continuation, you just continue to serve in the Air Force. All of your relevant ADSCs still apply, but there isn't any new ADSC for accepting continuation. If you do not accept, you have a few months to get out of the Air Force (6 IIRC). Be aware that this counts as an involuntary separation, but you won't get involuntary separation pay. The distinction matters because Big Blue processes involuntary separations for officers MUCH faster than voluntary separations. A voluntary separation has to work its way through all the wickets to the approval authority who is the SECAF. An involuntary separation is approved by literally some SSgt at AFPC. I was able to get out in just over a month.

Might be worth a call to your AFPC assignments officer. They might also take into consideration if you have a UIF or whatever.

Not trying to hijack the thread but I'm curious to know about if I don't promote to LtCol. Same thing? Or with this 5 look new system (anyone have any info on this all I got is rumint) would you just get to sanctuary and be good to retire?

-

15 hours ago, FDNYOldGuy said:

I like picking countries with demographics I like (young populations heading to consumerism, growing industry/QoL, reasonably stable governments, etc.) and throwing money in ETFs of those countries for my IRA. Still got a few years (although getting closer quickly, it seems) until I can access my IRA without penalties, so it’s a long play hoping the numbers do their thing. But, definitely have had some decent unrealized gains on the journey thus far.

Then again, these days, most US large/mega caps are pretty internationally diversified, so you’re getting decent exposure even investing in US companies.

Take a look at this article:

"This strategy beat the S&P 500 by four percentage points per year. Despite higher volatility (mostly the good “upside” volatility, by the way), it still resulted in a higher Sharpe ratio and lower drawdowns than sitting in expensive US stocks."

The chart that goes along with that quote is definitely worth looking at. CAPE might just be another metric you use to pick countries that look appealing to you. The point though, is these days I'm coming to the conclusion that diversification away from large companies / US companies might be a wise move. It is true that borders matter less and less, but if you're investing in expensive companies, international or not, your future expected returns will still go down.

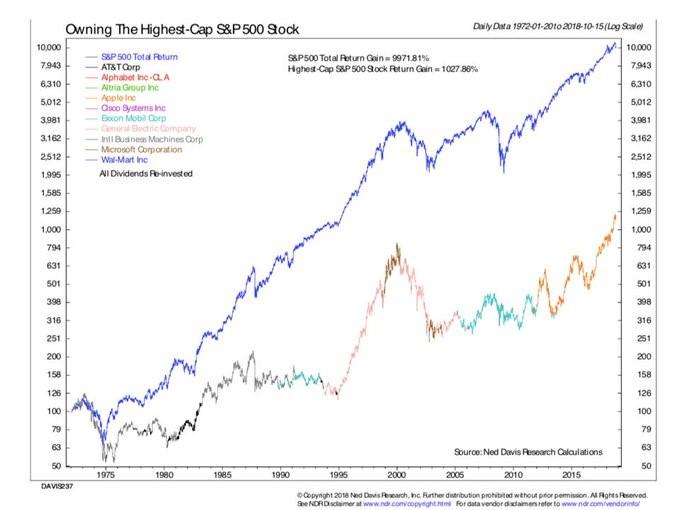

WRT investing in mega caps when they are the largest cap company at the time...see chart below.

-

1

1

-

-

How about avoiding home country bias and investing in the world instead of just looking stateside for investment opportunities? There's some good research by Meb Faber on global portfolios. Yes, here at home everything is expensive and there's not many good places to put money. But internationally that's not the case. In fact there has been research suggesting that buying the cheapest 25% countries overall beats the S and P, though will have some years of underperformance. That's the conclusion I came to. The US market is only 50% of the stock world and like 15-20% of the bond world. Anyone on here invest globally? Cambria has some interesting funds like GVAL that I've started diversifying into. Curious on everyone's thoughts.

-

On 10/1/2021 at 10:54 PM, DET1 said:

As the title says I accepted a bonus and now I want to pay it back and get out. I love the Air Force, but I’ve come into some money and want to pursue other goals in life. I recall the bonus paperwork going pretty high up if I decide to pay it back and get out, but was curious if any of you have any experience or know anyone that has done this? I want to have all my ducks in a row before I start anything formal so any recommendations you all have would be appreciated.

if anyone is curious I’ve made this money in investments and now I’m being recruited into some cool startups. I am not joking when I say I love the Air Force, but we only have so much time on this earth and I feel I want to take a gamble and try something new.

Dude be careful. I don't know how much research you've done WRT private equity but you go down with the ship as an investor if the project fails. Curious to know more details though, like will you be an LP or something?

-

On 9/14/2021 at 3:28 PM, dogfish78 said:

Stack silver. Live in a camper. Embrace the collapse. Hope the nation survives and purchase property, OR

Become an even bigger debt slave to the (((banks))) by purchasing property in this hyper inflated nation on the verge of becoming insolvent, OR

Eat the bugs/soy. Live in a pod. Take your 20th booster shot, OR

Be lined up against the wall and shot by the government because you've been labeled a dissident.

The choice is yours.

I'll bite. How much of your portfolio do you have in silver? How's that been working out?

-

1

1

-

-

On 5/14/2021 at 4:33 AM, BeefBears said:

I have a feeling that they will interpret the regulations to hold a continuation board at 2 years into the 5 year window.

Otherwise, the vast majority of majors are in sanctuary at the 6th year look. If this is the case, the major rank will become heavy and promotion rates to major will have to fall.

I also think AFPC has been intentionally quiet on the subject because they have no idea how to handle it.

Can you point me in the direction to read about sanctuary WRT active duty? When I looked into this that term was only used for ANG and Reserve. I could not find anything about sanctuary in the AD.

-

Sorry if this has been covered but...

I PCS for a short tour overseas unaccompanied soon. My wife will be living in the conus while I'm gone. I'm currently OCONUS but still in America. I would like my stuff to stay in storage for the full 1 year tour, as she will be living with family near my duty station once the short tour is over. Finance is saying I will make BAH so the government will not cover the cost of NTS (non temp storage) and I will have to pay that out of pocket for the year I'm overseas.

When I asked TMO they said the gov will pay for non temp storage.

She is listed as a dependent on my orders and will be allowed to move to a designated location.

What doesn't make sense is if she wanted to move to state X while I was gone and then move to my next duty station after my short tour, the gov would be moving our goods twice. If the goods are kept in non temp storage, they will only have to move them once to my duty station after my short tour.

Does anyone know the answer to this? Can you point me to a AFI or reg that covers this so I can go to finance and explain their regs to them if need be?

Any help appreciated!

-

14 minutes ago, CaptainMorgan said:

In your example, she’d only get 12.5%.

Sent from my iPhone using TapatalkYep that's what I meant. Not sure if it's state dependent. I know WA is community property law, that might factor in.

-

On 4/14/2021 at 3:32 PM, bcuziknow said:

She gets exactly 50% of your mil ret based on number points you have/had when you divorce - whenever you start drawing it. Sometimes more, rarely less. 20 yrs has nothing to do with it and for the most part, neither does AD/ARC. When/if you buy your mil time towards FERS Civ time, that doesn’t eliminate your mil retirement..it has no bearing whatsoever. Only issue is when you choose to begin drawing it. Buying your mil time only increases your civ retirement, does nothing to your mil retirement.

lots if variables in the above, however when maximized correctly, you can create quite the healthy/wealthy DEFINED BENEFIT RETIREMENT PLAN as a technician. I have many career airline buds who envy my retirement pension(s)x4 - granted they are all legacy big airline bros who got royally fckd by bankruptcies and mergers.

BLUF: your current (possibly ex) wife is entitled to and will get 50% of your 19+ yrs (insert grade here) military retirement whenever you begin drawing it, whether now or age 60.

Correct me if I'm wrong here, but 50% doesn't always apply. For example, if you get married at 15 years into an active duty, then retire at 20, you are with your wife for only 5 years of your 20 served. Therefore, wouldn't she only be entitled to 25% of your retirement, not 50? That's how a lawyer once explained it to me, in Washington state.

-

Question for you all. When I'm done with my current assignment (MWS IP) I will have 18 years TAFMS (I currently have 15 years in, just got here). I want to get back to my last base and finish my 20 out (also in my MWS). However, I'm at an OCONUS location, and the ADSC to PCS OCONUS to CONUS is only 12 months, so I THINK they can send me anywhere. UPT no longer requires an ADSC but I don't know if they would send me there with only 2 years left (would still need to do PIT and all that).

My question is, do I have any say in my final assignment, other than requesting it and hoping for the best? Is there any consideration given to your final assignment before retirement? It seems sanctuary only applies to ANG/ARC, not active duty (from the regs I've been looking at) so I won't have the ability to opt out of another assignment...I don't think. Ideas?

TSP Annual additions limit

in Squadron Bar

Posted

Nope you cannot add more than $20.5k (for cy2022) into a Roth TSP (unless a back door Roth TSP exists as mentioned elsewhere in this thread). My plan is to get to like $20.49k into the Roth at the beginning of the year, and then start dumping into traditional because I will be in a CZTE for almost all of 2022. My question was basically how do I do that through MYPAY and will the MYPAY system realize I’m in a czte etc.

my wife has been doing the back door Roth (kinda sounds dirty) for years now but I never considered it could be something I could do via TSP. Imagine trying to get information on how to do that from anybody lol I mean I can barely get a voucher processed correctly let alone find someone that knows what a back door Roth is.