-

Posts

677 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Gallery

Blogs

Downloads

Wiki

Posts posted by JS

-

-

Before starting at Kelley, I had no real business knowledge or interest. Now, my curiosity for everything business is insatiable. My MBA has turned into a launching pad for seeking more knowledge and being literate in the current business buzz.

Agreed. It also helps you understand things like TSP, Roth, taxes, mortgages, and lot of other things that I have ranted about in the threads on taxes and TSP investments. It is painfully obvious that a lot of people (and many on this message board) really don't understand how tax rates work or how to figure out the net present value of their mortgage and investment opportunities in order to make a more informed, optimal decision with regards to taxes, investments, and mortgages.

Going to Harvard and tapping into that network in a full-time program is powerful. Remember though, these people sacrifice 2 years of income, and incur tons of debt to get this opportunity.Very good point. I have had this discussion with a lot of smart people in the past. I think you have to pick your poison. A fellow grad of "State" MBA school would argue with me until he was blue in the face that going to a top-10 program is worth it, regardless of the costs, and that our mid-tier MBA was totally "worthless." I told him that for a lot of part-timers, the State MBA served to compliment their already rising careers quite nicely. His argument was always that Harvard MBAs were just a cut above the rest and that you would automatically walk out the door there with a $200K job offer. The big difference between me and him was that he had zero work experience and was sort of hoping that the MBA would get him started at some great $100K job. I reiterated that I made the same before and after my MBA at my civilian job, but my business knowledge was obviously higher and that the MBA would accelerate my rise in the company (unless I quit and joined the military, which is what I did, of course).

But either way, like you said, you have to take into account the opportunity cost (nice MBA term) of not working for two years as well as the debt to go to one of these great schools. In my case, I stood to lose over $150K in salary, just for the opportunity to go into debt $170K for Harvard or other similarly priced schools (several others are more expensive). In doing the Net-present Value calculations (wow, we learn the exact same MBA concepts at State that all AACSB schools learn), I figured I would just stay at my job, get the MBA for free, and continue doing what I was doing. That is over a $300K swing, not taking interest rates into account. Sure, you can probably land a nice job leaving one of the big MBA schools, but you might have to give up your job doing something you love near your hometown in order to be in the rat race in NYC doing investment banking or something like that.

But in the end, I tend to agree with you. Unless you are 100% sure that you only need to "check the box" and get the degree to keep moving up in the military or other GS government job, I would splurge a tad and try to get a reputable MBA that you can somehow get for an affordable price using the GI Bill or whatever.

-

Bump. Today is the last day for this deal through Livingsocial. I got my kit in the other day, and it is pretty sweet. I also ordered the 40qt stainless steel pot from Amazon. The kit is a pretty awesome deal for $63 ($125 regular on their website) considering all of the equipment it comes with, plus one recipe kit, plus a $25 gift certificate for another recipe kit. If anyone else orders it, PM me for my code.

-

Is it not true that most schools will not let you do an MBA program if you already have completed an MBA at another school? For exmple, I heard that if you get a bullshit MBA from one school and then try to go to a top University like the University of Chicago, you are not allowed to be admitted into their MBA program.

Does anyone know the accuracy of this statement?

A friend researched it while applying to Emory, I think, after getting a BS MBA. He said they told him "prior MBAs need not apply."

-

I typically find that with threads like these, it often ends up with everyone generally agreeing that something is wrong, but it's always someone else's fault -- very few people ever actually take responsibility for the way things are. It's senior leadership, or, it's the dirty careerists, or it's this or it's that, but no one ever actually admits being part of the problem.

I will freely admit that I am part of the problem, and not of the solution. My job is to fly airplanes (amongst other random officer-related stuff). My job is not to fix the Air Force. I am not exactly Billy Mitchell here. I am not going to sit here and sacrifice my financial well being, time with friends and family, and future employment prospects to start some sort of corporate cultural revolution. I'm not going to sit around well past duty hours writing manifestos and rallying supporters to this cause. And I doubt anyone else here will, either.

People promote the "work within the system and change it" mantra because it conveniently allows them to feel better about not changing their behavior, while still advancing their careers, draw a paycheck and bennies, and not making too many waves. And the vast majority of us are okay with that because those things are far higher priorities for us.

Pretty good thoughts. Kind of outside the box. At first, I didn't really agree with you, but after re-reading your post, I think you have a valid point.

So what is your solution - accept the status quo, make your money, spend time with the family, and then tell jokes at cocktail parties and online about how f-ed up the Air Force and the government are? That's kind of the view I take after living the stupidity for ten or so years.

-

I'd like to point out that you are assuming a person is taxed on the full $40K without regard to deductions, exemptions, earned income or child tax credits. A single person's return would reduce the $40K by an easy $10K which leaves $30.2K taxable. Tax due of about $4,106; based on $70K income, 5.9% effective tax rate.

Married with a spouse, no kids [and only one income] would make taxable AGI at about $20.5K with a total tax due of $2,209; based on $70K income, 3.2% effective tax rate. If the couple had a kid and only one income, then I'd say eff. rate more or less would be 0.00% due to earned income and child credits.

The point here is you rarely get taxed based on the W-2 Federal wage amount face amount, there are adjustments, so people need to figure all that in as well. Most good tax software, if not all, will give you the annual "effective tax rate" after you file. I go by that number in the end, but do watch the tax rate brackets in trying to get into the next lower one if possible.

http://turbotax.intu...tors/taxcaster/

FG,

You don't have to point out that I am assuming no deductions, exemptions, or credits. I already pointed out that assumption in my original post where I said " Ignoring all deductions, exemptions, tax-free BAH, credits, etc for illustration purposes."

Remember, I was just trying to illustrate that your regular taxed income and your combat tax zone exclusion income (notice is it not called "tax-free," because it is not tax free, it is just excluded for your overall income for tax calculation purposes) are both thrown into the same exact pot at the end of the year before your overall tax rate is calculated. That overall tax rate (after deductions, exemptions, etc) is what you should base your Roth/Traditional decision on, in my opinion.

-

There is associated risk vs return for each fund. Except for the G-Fund...it's a free lunch. There is no other asset out there these days that will give 3-4% return and protect your principle.

Vetter, you should know that there is no such thing as a free lunch - especially when it comes to investments and dealing with the government. Haha.

In all seriousness, though. Don't forget about inflation risk. There may not be any risk of loss of principle in the G-fund, but because the returns are so low, you have to beat inflation to get ahead. Here are the returns for the past few years on the G-fund versus the inflation rate:

2012 - 1.47 / 2.1

2011 - 2.45 / 3.2

2010 - 2.82 / 1.6

2009 - 2.87 / -0.4

2008 - 3.75 / 3.8

So, really, if your money was parked in the G-fund, you actually lost money in all but 2010 and 2009 in this example of the past five years. I always though that the G-fund was for people who were very close to retirement and really could not tolerate any form of risk and had to preserve capital at all costs (even the cost of losing money, like in this example).

-

nsplayer,

To your first question: yes, Roth contributions with deployment tax free money makes a lot of sense (you'd never pay taxes on it).

I would add this though - if you're deployed for 6 months of a given year, does it matter *when* you put the money in? At the end of the year, you're just going to add up all of your tax free earnings and and deduct it from your gross income. You aren't going to specify when you contributed to an ira/tsp. The money in the Roth is not going to be taxed when you take it out regardless, and the amount you put in will be the same. I don't think there's any difference between putting the money in an IRA/tsp during a month when you're deployed or putting it in during a month when you're home, as long as those months are both in the same year. If I'm wrong, chime in.

Bingo!! You are dead on with this. I had not read up on this thread in a while, and was going to respond to the 10 other previous posts that mentioned only contributing to a Roth while deployed. That makes no sense. The above bolded stuff is probably the most misunderstood concept that guys in this thread have.

To the poster who wrote about turning on and off contributions to the Roth before and after the deployment, you are creating a lot of extra work and creating extra confusion.

Like Jaded said, your 1040 tax return does not give a shit when you earned tax-free CTZE income. Your W-2 does not give a crap when you earned CTZE income. Also, your Roth doesn't give a shit whether or not you earned tax-free income or not, it just cares that money is coming into it. Of course, that money going into a Roth is after taxes, whether or not you deployed, had deductions, etc. Again, the money you earn in a CTZE is not somehow specifically electronically marked as "combat pay" when it goes into your bank account or when it is taken from your LES and put into the TSP. It all goes into a pot of money that is sorted out when you (or TurboTax, Taxslayer, etc) do your taxes by entering the taxable amount from your W-2 into your 1040. That taxable amount does not include any Q-code tax free combat zone income.

Also like Jaded eluded to, it makes the most sense to look at taxes, tax rates, income, and investments over the course of an entire year. You may as well get out of the mindset that you have to contribute to after tax accounts (Roth) while you are actually in a combat zone because that money is tax free and will come out tax free. In actuality, that investment into the Roth is not tax free at all. Even if you physically put it into the Roth from your laptop while you were taking mortar fire while hiding under your bed in Kandahar, that money still most likely got taxed due to your other, taxable income that year (did I mention that you have to look at taxes over the course of a year and not by the month???) Here is another illustration to prove my point:

You deploy for 4 months and end the year with 30K CTZE income and 40K of "regular," stateside taxable pay. Ignoring all deductions, exemptions, tax-free BAH, credits, etc for illustration purposes, you will receive a W-2 in January that says 40K taxable income on line 1 and on line 12 will have Q 30K of tax free income (again - no sign of the timeline as to when you earned the $30K of CTZE income). Your tax software will then crunch the numbers, and you will pay taxes on the 40K and will owe about $6K, or about 15%. Of course, your annual income was indeed $70K, but you still only pay $6K in taxes, for an annual tax rate of about 8.5%. So in this manner, I can easily say that your tax-free income was actually taxed at 8.5%, just as your stateside income was taxed at 8.5%. Why? Because taxes are calculated annually, not monthly. Did I mention that?

So, whether you transferred the $5K from your bank account into the Roth IRA when you were in the CAOC or at home in Cannon, sitting in your PJs sipping coffee, the money you put in to the Roth was taxed at 8.5%. You earned tax-free income that year, but your Roth contribution came out of the same pot that your taxed income did - the $70K pot. So, in the end, guys can imagine in their heads that the money they are putting into a Roth is "tax-free" going in and "tax-free" going out just because they were in a CTZE for part of the year, but that won't be entirely accurate (unless they indeed were deployed all year or for whatever reason literally paid 0 taxes for the entire year).

So to answer the other question about SDP vs Roth investments while deployed, I would definitely take advantage of the SDP while deployed, since that is indeed a CTZE-only investment offering where the government is no-shit subsidizing your investment and paying you 10% of risk-free return (unheard of in the private sector). While maxing out the SDP in the deployed zone, you can still be following your regular investment plans into the Roth TSP, TSP, Roth IRA, or regular IRA as scheduled. You can continue your Roth investments on a monthly basis throughout the year, or a lump sum at the end of the year, or for the imaginary benefits of tax-free inputs, you can tailor your Roth investments to only take place during the months you are deployed. Either way, you can do SDP at the same time.

My personal strategy is to do a lump into our Roths at the end of the year, because I want to be sure that I didn't mess up my tax calculations with my side business, investments, mortgage interest, etc. and owe the IRS money at the end of the year. I almost always get a big refund as planned, and then just use that for the Roth contributions. By the way, you can contribute to the Roth IRA up until tax day (April 15) of the next year. In other words you have until April 2013 to contribute into the 2012 Roth.

Again, in the end, the decision to go Roth or traditional should be decided when looking at your tax rates for the entire year (did I mention that before?) and not by mentally separating out CTZE income from regular income, because they are essentially the same when look at your income over the course of the entire year.

-

1

1

-

-

Anybody taken the ATP written at an AF education center yet? Is there any harm in showing up and taking it cold since its free? Does your grade show up somewhere the airlines can see it or is it just pass/fail like ACSC, etc?

That sucks that education centers are doing away with it. I took two at TInker when I was there and it saved me some money.

To answer your question - do not take the ATP written cold. You have a 0 percent chance of passing it and will waste everyone's time. This is not a test of your overall aviation knowledge - it is a test full of extreme queep and weird shit that you simply will not know unless you have specifically studied for it.

Also, if you fail, I seem to remember reading that an instructor had to sign you off for additional training or something. Plus, you never know when you are going to get an interview question asking you if you have ever failed a written or practical FAA test. I would rather not have it out there. Study with Sheppard Air, then take the test.

-

I played football in college. I'm 33, and 1 each of my knees and shoulders are code 2, my back hurts daily, and it's possible that my frequent foul moods stem from repeated blows to the head. It was worth it.

Ha. Funny analogy. For comparison, I did not play football in high school or college and being in my mid-30s, I have many of the same problems. Right knee has been A3 three times for surgery. Back is A2 most of the time, and left knee and right shoulder are intermittent at best. So maybe football doesn't have anything do to with pain later in life. Maybe it is just getting old that does that.

-

Because your IRA options are Roth or Traditional, and Traditional is taken off the TOP of your tax bill (your highest marginal rate), then that rate must be considered and applied toward the alternative, the Roth.

I think I see where your logic is coming from and what you mean by marginal vs effective tax rates. This is a great discussion, by the way, and very important for most folks to understand. But I still honestly believe that you and I are looking at the exact same numbers in a different way, and that you are interpreting tax rates incorrectly.

You are saying that if you dump the $5K into a Roth, that $5K was taxed at your highest marginal rate (say 28% if your taxable income was over $80K) because had you put that into a traditional, tax-deferred plan you would not have been taxed on that last $5K at 28%. I disagree with that line of thinking. For the sake of argument, what if I were to say that my $5K Roth contribution came from the first $5K of my income, which is of course taxed at only 10%???? So was the $5K in this situation (both individuals earning $85K taxable income) taxed at 10% like my argument says, or 28% like your argument says? Neither argument makes sense, which is why I keep coming back to the average, effective tax rate as being the sole number that I look at when making these types of decisions. I just don't see how it makes sense to look at investments and single out certain tax rates. It's almost like you are cherry picking tax rates for your argument - "Roth contribution is taxed at 28% but traditional but retirement withdrawal is taxed at your effective of 20%." Like my above linked article says about tax rates, your $5K of money hits every tax bracket on the way up to 28%. The first $5K of the year that you make is indeed taxed at 10%, even if you make $85K for the year. And yes, the last $5K you make that year is indeed taxed at 28%. Hence the concept of averaging the rates out to come up with an effective tax rate, which is the only rate I believe you should look at for an apples-to-apples comparison.

If you haven't done so, read the article above on how tax rates really work. The fact that you mentioned the phrase "getting knocked into the next tax bracket" means you truly don't understand taxes or tax brackets. Most people don't. There is no such thing as getting knocked into another tax bracket, ever. Period.The use of that phrase tells folks in the tax business that you don't understand tax rates. As the article illustrates, when you earn the proverbial additional dollar going from $80,000 to $80,001 for the year, your overall tax rates do not go from 25% to 28%. Period! Your marginal tax rate changes to 28% for any additional income over $80K, but your overall tax rate for the year went from 20.625% to 20.626%. Do the math and run it through a tax calculator. That additional dollar, which "bumped you from the 25% tax bracket into the 28% tax bracket" will literally cost you $.28 in additional taxes, not the $2,000 that some people think. Again, in case I haven't mentioned it, read that freaking article on tax rates if you guys are going to read anything on this argument.

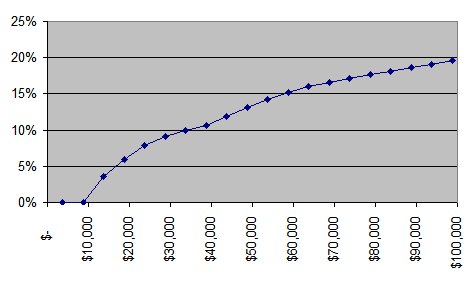

Just to slaughter the already dead horse one more time, here it is graphically. Each additional dollar you earn incrementally increases your overall tax rate for each additional dollar you earn, up to infinity. Your tax rates never spike. If you were to graph your overall (effective) tax rate versus your income, it would be a nice, smooth, increasing curve from middle-school algebra. The graph doesnot look have a series of vertical lines, or jumps in your tax rates like some people think:

How tax brackets work (2007 IRS total tax numbers):

How tax brackets do NOT work (ignore the titles on the axes, just something I quickly grabbed from the web):

EDIT - just to add a caveat to my "you never can jump into another tax bracket" argument above. One way where your overall tax bill can spike would be through the Alternative Minimum Tax (AMT). They keep making exceptions to it, but it really only starts to kick in when you are earning way over $100K from what I understand. I hadn't done more then a cursory review of it, since it doesn't apply to me, but from what I understand, if you literally hit a certain dollar threshold, then deductions and credits start to be disallowed, and your tax bill can indeed spike dramatically with the addition of a single dollar of income.

The logic in my argument above about being bumped into lower/higher tax rate brackets and seeing spikes in your income due to that still stands, though. That is just not the way tax rates and tax brackets work, in case I did not mention that already.

For a point of reference, here's an example with two single-filers who each made $80K in 2012, Person A and B:

A/B

80K/80K = Total income

-5K/-0K = Traditional IRA contribution

75K/80K = Taxable income

14779.60/16029.60 = Taxes paid

60220.40/63070.40 = "Take home" pay

-0K/-5K = Roth IRA contribution

60220.40/58070.40 = Final income after taxes and contributions

Person B paid $2150 to shelter $5000 in their Roth. When Person A withdraws their $5000 in retirement, they will pay the effective rate, assuming their income during retirement comes from their retirement savings. If we assume that Person B saved really well and will have the same income during retirement ($80K), then in this scenario they contributed to their Roth at the 25% marginal rate to avoid a 20% effective rate.

Credits are irrelevant because they're dollar for dollar returns. All things equal, a $1000 child tax credit for Person A and B is $1000 in their pockets.

Deductions are irrelevant also, though slightly more confusing as to why. The deduction you get for contributing to a Traditional is on top of other deductions. So again, if all things are equal, then Person A will have $5K more in deductions. The only difference, which is in Person A's favor, is the possibility of their additional deductions knocking them down to the next marginal tax bracket.

Or you can go with the pros. That's fine too.

I agree that if you are comparing person A to person B, then credits and deductions don't count, because both get them. I am not trying to compare person A to B, my strategy is to figure out if person A (me) is going to have a lower overall tax rate today or if person A (still me) is going to have a lower tax rate at retirement. From that standpoint, deductions and credits matter, because like others have said, you most definitely won't have mortgage interest deductions, child tax breaks, military tax-free pay, etc. in retirement. Plus rates are lower now too. So my summary judgement is that we have lower rates today and over the past few years, and my personal effective rates that I illustrated proves that.

Also, I don't think you have to count on BAH and combat pay to have a low effective rate. Remember, Joe Schmoe with a mortgage and a few kids gets a ton of tax reducing items that he will not have in retirement (assuming the house is paid off and the kids move out - two things that are unfortunately very far from a given these days).

-

1

1

-

-

Yeah, I definitely don't agree with some of the stuff in your post. I think a lot of people get confused with "tax-free money" from a deployment versus other deductions. Unless I have misunderstood it all these years, here is how I think it works: at the end of the year, you have an amount of income that gets taxed (adjusted gross income). Things that can reduce that amount include tax-free income, mortgage deductions, business/investment losses, mileage write-off for traveling reservists, etc. Your calculator does not care which items reduced your AGI, it just cares what your final AGI is. That number is then looked up in a table and you pay XX percent taxes on that number. That tax number can then be reduced further with credits such as the child tax credit, etc.

The money you earn in Afghanistan is not somehow specifically marked with traceable serial numbers as tax free money which can be invested in a Roth, as some people think. Actually, every income earner in the country receives some form of tax-free income. It is called the standard (or itemized) deduction, and the standard deduction for 2012 is $5950 for a single person. There are also deductions for dependents (including yourself), known as exemptions, that make your taxable income even lower. So in other words, ignoring the personal exemption for illustration purposes, if you were nonmilitary and you worked for the man earning $36K, you would be taxed on $30K after taking the standard deduction, so about $6K of your income is tax free, just the same as income earned in a tax-free combat zone.

Another example (with numbers simplified, not counting exemptions and other deductions, tax free housing allowances, and all other things assumed to be equal): Say single person A is not in the military and works for the man earning $56K per year. That person takes the standard deduction and pays taxes on $50K, which is a little more than $8K. His effective tax rate in this example is $8K/$50K = 16%

Say single person B is a captain who deployed for 3 months and earned a total of $68K, with $12K being combat tax-free income. He will pay taxes on $68K - $12K combat pay - $6K for the standard deduction = $50K. The same as person A. His tax bill will be a little more than $8K as well. His effective tax rate is $8K/$68K = around 12%.

Assume person C is not in the military but paid $18K of mortgage interest and worked for the man earning $68K/year (assume the others lived in apartments or something). He will be taxed on $68K - $18K for the itemized deduction of the mortgage interest = $50K. He will also pay about $8K in taxes and have an effective tax rate of 8/68 = 12%

My point is that all three have “tax-free income” and if all three put their $5K into a Roth, they would all be in the same boat financially that year and would be able to withdraw the Roth earning at retirement without having to pay taxes on it. So I completely disagree with your statement that mortgage deductions and child credits are irrelevant. Those items reduce your tax bill and lower your effective tax rate in the exact same way that combat pay does. In my above example, the military guy who lived in an apartment but got 3 months, $12K of tax free combat income has the exact same tax bill and tax rate as the civilian guy with the $18K in mortgage interest. So your thoughts on guys with staff jobs or civilians not having items that dramatically reduce their tax rates are completely out of line with the way I understand it.

Here is the very simple way I decide if I should invest in after tax dollars and withdraw tax free (Roth) or invest in tax deferred dollars and pay taxes at withdrawal (401K, IRA, TSP, etc): do I believe that my effective tax rate will be higher when I withdraw the money at retirement, or do I believe my effective tax rate will be lower today. As I mentioned, my effective tax rate (and most Americans for that matter) has been pretty low over the past decade thanks in large part to lower overall rates and things like the mortgage deduction and child tax benefits. I am indeed betting that rates will go up (they obviously already have starting this year) and that the mortgage and child tax benefits will be cut away in the years ahead. Also remember, tax rates over the past decade have been at the lowest in decades – during the Carter, Reagan, Bush 1, and Clinton years tax rates were higher. Now they are coming back up again.

Over the past six or seven years, our household has brought in roughly $100K/year income between me and my wife (a little more recently due to promotions, etc, whatever). Here were my effective tax rates over those years:

2011: -0.3% (no, the IRS did not actually send me more money back than they withheld)

2010: 5.3% (this is the year I rolled over my old employers 401K to the Roth, so I had an additional $25K of taxable income that year, pushing our income levels for the year way over $100K)

2009: 1.5%

2008: 4.1%

2007: 0.3% (bought our house this year)

2006: 7%

So, in the end, I am literally betting my retirement on the assumption that my effective tax rates will never be this low again. I think the writing now, even more so than in the past, is very clearly written on the wall. Taxes will go up and deductions will go down. Plus we will continue to make more money in our careers, so it made sense for me to pay the tax on that $25K back then. As you can see, I ran the numbers and even with the “spike” in my income that you mention, my tax rates were still pretty low in 2010. (insert standard bullshit disclaimer here – everyone’s situation is different, when in doubt, throw your money away on some tax “professionals” or “investment advisors” instead of figuring it out on your own. Or, as some say on this board, your mileage may vary.) Also note that during the above years, I never had more than about 3-4 months of combat zone time in any given year, so the low rates aren't unique to just military guys (see Mitt Romney). The truth be told, after all the deductions, etc. rates have been pretty low for everyone.

When you contribute to a Roth IRA your taxes are front-loaded at your marginal rate (your highest).

This is completely not true. As I illustrated above, each year, you are going to wind up with X dollars left over after the dust settles and you pay your federal bill. You will have paid a certain effective tax rate. If you happen to have $5K sitting in the bank for whatever reason (could have been there for 10 years, for example) and toss it into a Roth, that money was not taxed at your highest rate that year. I just don't see how that is possible. I think you, like many others, are very confused about how marginal rates work. When you go into a new bracket, only that portion above the last bracket is taxed at the higher rate, not your entire income. That's why the lower bracket rates are all averaged into your overall tax bill to give you some strange effective tax rates like 10.5% or 13.1%, or whatever. This article tries to explain marginal rates and brackets a little more.

With a Traditional IRA, you are taxed on the back-end, during retirement, at your effective rate (based on ALL tax brackets).

...But remember to include the large differential between marginal rate (Roth) and effective rate (Traditional).

I have read these two lines about five times already and really don't understand what you are saying here. Effective tax rate is basically just an average of all of the marginal rates that you hit on your way up to your final marginal rate. That way, for example, if you ended up with $100K of taxable income (clearly deep in the 28% marginal tax bracket), your effective tax rate would be something like 20%, because you would average in all of the lower brackets that you passed on your way up to $100K, just like that article illustrates.

So, the dough you put into your Roth, just like all of your other dough that year (see above) was all taxed at your effective rate. The dough you take out of the 401K at retirement is also taxed at your effective rate. All of your income, all the time, is taxed at your effective rate at when you look at it over the course of the entire year. That's why I simplify the decision by simply trying to guess if I will have a lower effective rate today (Roth is better) or at retirement (401K is better). But to say that if you are in a staff position or don't have tax-free combat pay, that a traditional tax deferred IRA/401K will always be the better bet is just dead wrong.

-

Ha ha. Good point. But then again, I trust the opinions of a lot of people on this board - especially the guys I have met in person - more than I do some of the idiot tax preparers at H&R Block.

My philosophy with looking things up on the internet is this (I am sure a lot of people have the same philosophy): If I have a tax, legal, or medial question, I am not so fucking stupid to not realize that I might/probably have to contact an accountant, lawyer, or doctor. But, like most informed consumers, I usually feel a 20-minute time investment on the internet is worth it. Maybe I can find the right answer, but I think anyone with an IQ above 25 knows that the backup plan to searching the internet for advice is to contact the professionals who handle that field. I just hate it when you see 20 replies to a tax question all have "you need to contact an accountant." No, shit. I really would not have known that had the 20 of you not posted that. Maybe the person can't afford a professional, or maybe they would at least like to see if others have had the same issues and how they handled it.

Anyway, you are right. When in doubt, contact an accountant to fix this small tax mess.

-

I actually did something very similar - transferred a 401K into the Roth with USAA to pay the taxes now while my tax bracket was low due to the mortgage interest deduction, child credits, deployment tax-free income, etc. I believe when I paid the taxes on it, my effective rate was still only like 5%. For the most part, your taxes will not be much lower than they are right now if you have a mortgage, kids, or any tax free deployment income.

When I converted, I received a 1099-R, which, like all 1099's just signifies income being disbursed to me. The "-R" if for money coming from a retirement account just like a 1099-INT is for interest from a savings account and a 1099-MISC is for income from miscellaneous jobs not on a W-2. The disbursement code on my 1099-R was "Q," which means it was disbursed to another plan (a rollover), so no penalties or taxes were taken out. Make sure your 1099R has this code, otherwise you might get screwed.

From there, I plugged everything into Turbotax like I do every year. For some reason, Turbotax choked on the Q code and didn't ask me to take out taxes. After calling the IRS, they advised me to just manually rig the numbers in Turbotax to show that I received the $50K, or whatever, through a taxable, zero-cost basis, transaction. Turbotax then took the taxes out.

I did my rollover in 2010, and during that time they had an option to spread the taxes out over two years. From what I have read, that is no longer an option, and you would have to have paid the taxes in your 2011 tax year.

Remember, 1099s don't get taxes taken out of them. That's why people with their own businesses who receive income on a 1099-MISC must prepay taxes through out the year, because none is withheld Same with a 1099-INT or 1099-R, no taxes will be held, so it is up to you to correctly report it and pay the taxes manually.

So, the solution is what the person above stated - you will have to file an amended 2011 return, listing the rollover as taxable income from a 1099. Again, I used Turbotax, and once I manually got around the Q-code glitch, it guided me toward paying the taxes on the amount of the rollover.

If you really want, I can sent you sanitized copies of my 1040 and the form that TurboTax filled out for the rollover to help you. That form was IRS Form 8606, by the way. And as I have mentioned, the key was to manually rig that form for a "zero cost basis" for the rollover, thus making the entire amount taxable. That's what the IRS guy told me. After that, the amount of the rollover was simply placed on line 16b of my 1040 for that year. So, really, you just have to fill out the two pages of form 8606 and then file an amended 1040 with that extra line filled out.

PM me if you want copies of the forms I filed. Or you can pay that "tax professional" a couple of hundred bucks to do the exact same thing.

-

I like this company too: http://www.midwestsu...tarter-kit.html

Theye cheaper than the first one I suggested.

Either way you're gonna need to get a boil pot. Splurge now and get a 40 qt stainless brew pot. save your money and frustration and DO NOT buy aluminum. The benefit of starting with the larger pot is that when you transition to all grain brewing you'll already have a pot large enough to handle that process.

You will also need a thermometer. If you already have a kitchen one that you cook with, that'll be just fine.

Livingsocial (Groupon competitor for those who are not married) has a deal on the Midwest starter package right now. It looks like it is the same starter package recommended here, but it also includes a $25 coupon for a future recipe kit. The kit goes for $126 on their website, and the Livingsocial groupon is selling it for only $67 bucks. I think I am finally going to splurge and get this kit - it sounds like a pretty good deal.

Also, looks like Amazon has a good 40-quart stainless steel pot w/ Amazon Prime for a lot less than the Midwest Supplies website sells them for. Oh, and it looks like the kit comes with a thermometer, so the only extra things you have to buy will be the pot and bottles (or save your own.)

If anyone is planning on buying this livingsocial deal, PM me so I can forward you the link and possibly get it for free

-

So just so I get this straight, most people on this board have had great experiences with auto insurance and the car buying program offered by United Services Automobile Association, also known as USAA, but for the most part have had bad experiences with an automobile service company doing mortgages and investments. Sounds about right.

-

I know that if you were a legacy Herk IP you can accomplish IP upgrade in-house.

I believe that is the case across every MWS - as long as you have been to some Big Blue instructor course, you can upgrade to IP in your new MWS in house. I know we have a few guys from other airframes that we sent to IP school anyway, and others upgraded in house.

For the original question - I went a little over a year ago. All sims - 10 total, peppered with academics and about 4 different presentations to the class on TOLD or systems. It was all right-seat stuff - 3-engine, assault, NVG, etc. Checkride was with a dude from the 48th and was pretty low threat. If I remember, about 3 rides were transition type stuff with assaults, approaches, and 3-engine stuff. There were quite a few NVG rides, and about 3 or 4 formation rides too, including the checkride.

When I went through, they were trying to keep guys with the same IP for most of the program. I think we had the same guy for 7 rides, then two other dudes, then the check. So there was good continuity. Our dude was very cool, but I heard some IPs make it not as laid back and fun. Most of the stuff they pull on you is stuff they say that have seen in real life - throttle chop short of the assault zone, wrong rudder on 3-engine go, hard landing, accidentally taxiing when both guys are heads down in the box on NVGs, etc. Only unrealistic thing is that you probably wouldn't see ALL of those things on the same ride, but they are limited in how much they can show, I guess.

Overall, it was a good course in my experience. Let me know if you have any questions.

-

All I keep thinking of is a quote from a great veteran of this board:

And that was "way back in the day" in 2011 when the dismantling was not even in its infancy.

We are in desperate need of honest debate in this country to decide things such as how many social programs we want and how much we are willing to pay for them versus how much national defense we want and how much are we willing to pay for it. This is getting crazy.

-

Maybe my wording got lost in my attempt at cynicism, but you don't think that all three branches (if you want to call them that) of the Air Force - Guard, AFRC, and AD - are going to throw out the political card and all three ultimately wind up losing in the end?

To me, I really don't see much of a difference - politically - in closing an active duty base or unit versus a guard or reserve unit. The local and state politicians are going to be just as up in arms. Would the senators and congressmen from Mississippi sit by and watch if the AFRC Herks at Keesler vanished as opposed to the guard C-17's in Jackson? Would the politicians do nothing if they tried to close an active duty base in the state such as Columbus, as opposed to, God-forbid, the Northrop Shipyard?

Look at Georgia. I have a feeling that the "powerful politicians" would be just as pissed if the AD mission at Moody was BRACed, or if the AFRC planes at Dobins disappeared, or if the Guard unit in Macon closed, or if something happened to prevent the Lockheed Plant in Marietta from producing more Herks.

I throw these major civilian businesses associated with each state into this argument because I believe those entities are playing a large role in the horse trading that is going on at the Congressional level that will ultimately decide which Guard, Reserve, and Active Duty units stay open.

-

The guard has one powerful weapon that the active duty forgot about - politicians. The politicians are going to fight this one. In fact, it is already being discussed at the their level. It will be interesting to watch no doubt.

Well, skibum saved me the trouble of typing 50 % of what I was going to say in response to the above post:

AFRC units have political advocates that also will have say (e.g., Niagara and Hillary last time around).

Does anyone think that Active Duty, just like the Guard and AFRC, also has a tad bit of political clout and lots of lobbyists in DC?

So in summary, all three parts of the Air Force have political clout that is going to prevent the other two parts from taking "their iron" and closing "their bases," right?

This is going to get ugly and not make a lot of strategic or operational sense within the Air Force, but that is how it has always been - politics will primarily decide how this shit pans out.

-

If you have a .edu email you can get Office for $40.

You can also get 6 months of free Amazon Prime, and then half off per year thereafter ($39/year) with a .edu address. I know it is a little late, but I have found that Amazon Prime really pays for itself around the holiday times. Since it is free 2-day shipping, I am also getting a bunch of little things for around the house from Amazon that I am too lazy to go to Walmart or Lowes and get.

-

OSU beat more nationally ranked teams, Bama only beat two...

Bama only beat 2 ranked teams? Fact check time:

Everyone and their brother was screaming that the National Championship had to be Ohio State vs Florida, because even though they were ranked 1 and 2 you couldnt have a replay between Ohio State and Michigan.

Funny how all the SEC fanboys change their tunes when its talk of their conference getting to hold both berths and not anybody else.

If memory serves me, that BSC championship game was between #1 and #2 - just like the rules say it will be. The big 10 didn't even play a conference championship game that year, so what the heck are we talking about here?

Being an Auburn grad, .... be a ligitimate national champ.

I can see the Auburn spelling coming out here. That checks.

Wow - a 30 yard lucky pass into coverage was your favorite play? Time to watch more SEC football. Did you see any of Trent's "Heisman runs," or the Honeybadger at work, or anything like that?

In my opinion you are required to be a conference champion to be able to play for the national championship!

So your opinion says that two different teams should play versus what the BSC rules say? Makes perfect sense.

I would agree with you if you said something like "perhaps there should be a rule that states you must be your conference champion to play in the big game." The current rules don't require you to be a conference champion to play in the BCS title game, hence the reason why #1 is playing #2, again, just like they have since the inception of the BCS (see above).

So what happens if Alabama wins the rematch? Each team would have one win against the other. Who is the national champ then? Alabama because their win is the most recent? How fair is that?

And what happens to Alabama if LSU wins? Does Alabama stay at #2? They are "the second best team" after all...

So what happens if a team wins the BCS Championship game????? I will have to check the rule book on that (after I recheck the conference champion requirement rule that doesn't exist), but I will bet a weeks salary that the winner of the BCS Championship game will be the BCS champion. I could be wrong, though. Fair or not.

In all seriousness, though, I hear that if Bama does win, there might be cries for another "split championship" with the AP title going to LSU. That's possible, but the BCS was supposed to have eliminated that confusion and controversy. I think if Bama wins, controversy will reign because each team will have only 1-loss to each other, but the BCS national champion will obviously not be in dispute - the winner will raise the crystal football.

-

1

1

-

-

Cool. I thought the Montgomery GI Bill Selected Reserve was in the same bucket as the Montgomery GI Bill, but it turns out that the Reserve one is chapter 1606 and the active duty one is chapter 30 (post 9/11 is chapter 33). That is probably the difference, somehow in the VA's convoluted way of making things confusing.

-

2.

I got mine done through Accessible, but I would caveat that I didn't exactly "know my shit" after spending a mere day and a half and only 2 and 1/2 flights there - the last flight was a quick, one approach "wind check" to warm up for the checkride. But Carl definitely crammed nothing but the exact stuff that you needed to know for the practical into those 2 days - no more, no less. To be honest, I kind of got my butt kicked on the checkride itself because I hadn't flown old-school instruments, single-pilot, with an unfamiliar GPS in quite a while. But it definitely helped that the examiner was very understanding of the whole military thing and how Carl only sends the "best of the best" to him for their ATP checks

.

. -

It should be ANG, or "centrally funded" in AFRC, so it should not come out of unit funds. That was my understanding when I went.

Masters information (MBA/GRE)

in General Discussion

Posted · Edited by JS

For the record, I am a fan of getting a decent MBA, and I strongly believe in networking and making your own luck. But since you asked, I can easily show you how one can "argue with the stats" in this case with regards to median incomes and starting salaries.

1. For starters, all of the median incomes a school publishes are heavily biased, because the school publishes them. There is obvious incentive to make those numbers as high as possible to dupe people into thinking that every one who pays $170K for their MBA will automatically walk out the door with a $200K job.

2. These numbers are gathered through surveys of alumni from the school. Say, for example, that there was hefty unemployment among MBAs at said school. Do you think the unemployed will respond to the surveys and write back to the school that their salary is $0? That would heavily skew the median. Reality is that a very large percentage does not respond to the surveys either because they are unemployed, or are perhaps working menial jobs making average money that they don't feel is worthy, literally, to write home about. Either way, the numbers will be rigged on the high side.

3. By definition, median is the number that can be found by lining up all the salaries and "picking the middle one." There are a lot of ways that can be very deceiving and misleading. The salary breakdown could easily have 49 graduates making $70K, 1 person making $200K, and 49 people making $1M. That would put the median salary at $200K. This, of course, doesn't include all of the $0 salaries that probably weren't reported.

4. Even if the distribution of salaries did look like my previous example. How/where did the 49 alum making $1M make their money? Did they have "normal" salaries of $70K before going to Booth and then their salaries jumped to $1M the day they graduated? Or did they perhaps inherit Daddy's company or Daddy's connections to get promoted? Or were they just superstars before they even started business school, and they just continued on their upward path regardless of getting the MBA? I always have had heartburn when people talk about median salaries, because they honestly believe that there is a chance that they will automatically start at that median salary simply by graduating from said school.

5. What time frame is the data from? Does it include alums who graduated 60 years ago and have had a long, successful career building up their business or salary? If their high salaries were included in the mix, that sure as hell would skew the numbers pretty good. Matter of fact, a lot of recent graduates would have to make much less than the median in order to balance out the high-earners in the calculations.

6. Are the numbers being reported even accurate? Let's say, for example, that all respondents of the survey came back saying they made $200K/year. Do you think Chicago verifies that by asking for tax returns, W-2s, or other evidence? What if those numbers were inflated to make the respondents feel good or something?

7. Is that private sector only, or does it include public jobs?

I will bet my MBA, along with a years salary, that if 10 random Air Force dudes all went to the University of Chicago at age 31, they would not all be starting at jobs paying $200K after graduating with the MBA. I think you will have fast-burners who will succeed anyway, and you have people who get an advanced degree to try and compensate for a lack of talent in the "real world" of business. Either way, there will be major disparities in income between graduates from the same MBA program.

Remember, there are lies, damn lies, and statistics. I used to say that I could debunk, throw enough doubt into, or make irrelevant most every statistic. Now, I can confidently say that I can make irreverent or debunk all statistics out there. I have given that challenge to a lot of friends, and so far I have not been proven wrong. My point is that you have to be very skeptical when looking at these average starting salaries and such coming from these expensive schools.

One more story. There was an article in the NY Times a while back (too lazy to try and look it up) about a bunch of lawyers who graduated from a mid-level law school. Of course, the "average starting salary" was something like $90K or something. Plus there were some very questionable statistics about the 90% employment rates of the law schools graduates. Of course, of the 2/3 of the class that were lucky enough to find jobs, most were for like $40K, part-time, or didn't require a law degree. The graduates corresponded with each other and the math just didn't add up. With a little digging, it was obvious the school used classic statistical deception with the numbers - included a few high-salary law partners in the numbers but somehow excluded all the unemployed or entry-level jobs or some crap. And what did the load of recent-graduate, blood-sucking, scumbag lawyers do in return???? Yup, they sued the law school. Classic.

Actually, here is a followup to the original NY Times article.